Traditional car trade distribution seems to become an outdated model

The traditional car trade distribution scheme from the manufacturer to the dealer and on to the customer seems to have become an outdated model, driven by different trends. The “eascy” factors electrified, autonomous, shared, connected and yearly updated are spinning the automotive wheel of transformation. The dealer landscape is already changing, due to ongoing consolidation, the use of new sales channels and the emergence of new forms of mobility. In addition, customer expectations of the products, services and experiences offered by the car trade will also increase.

In order to describe the future of car retailing PwC Automotive has conducted both, a dealer and customer survey to understand how the dealer needs to prepare to serve the customer of the future properly.

The study at a glance

Physical retail

The majority of dealers expect the traditional sales channel to lose importance. At the same time personal advice is the highest priority for customers when buying a new car.

Need for action

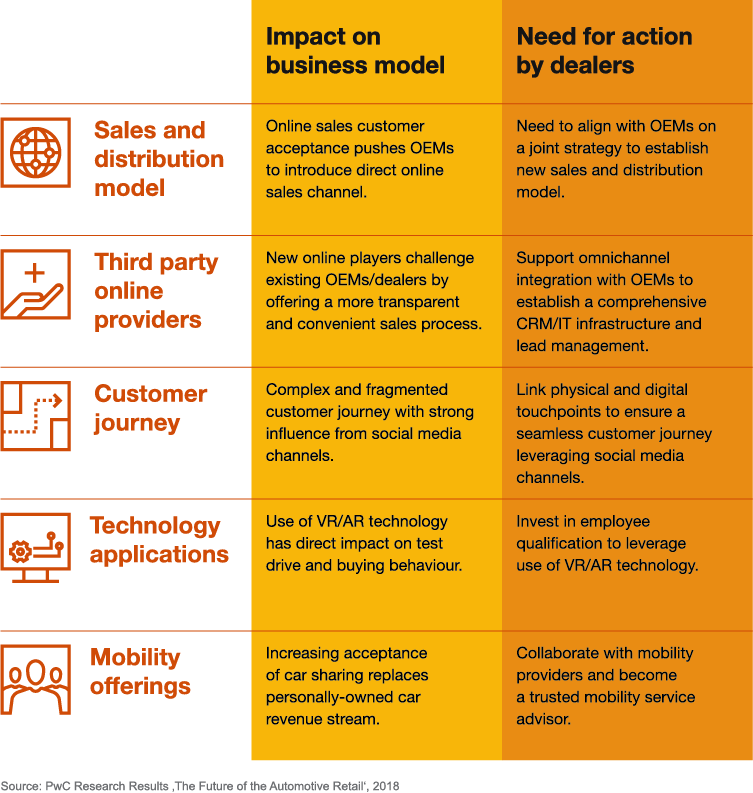

Tight cooperation of dealers with the OEMs: If OEMs apply the direct online sales channel, thus affecting sales and distribution model, a sound and mature strategy with dealers will be required. However, dealers need to make investments and be willing to support the transformation.

Digital retail

For dealers, direct sales by OEMs and online sales platforms run by third-party providers outside the industry are seen as the greatest threat to the traditional car retail model. This threat seems to be valid since 63 percent of customers would buy directly online from OEMs and 50 percent via a third party’s online platform.

Need for action

Closely interlocked Customer Relationship Management: Dealers and OEMs need to enhance their joint efforts on omnichannel management/integration to avoid losing customers to third party online providers. This requires a comprehensive CRM system and an overarching lead management process between OEMs and dealers. Furthermore, they need to ensure a seamless customer journey that combines both the physical and digital world. This requires a single view of the customer which can only be achieved jointly by the OEM and dealers. In addition, dealers need to enhance their competencies in social media.

„I thought I knew what was coming – but so far, I don’t have the slightest idea. There is no concrete (digital) strategy.”

Customer behaviour

50 percent of dealers see as the biggest challenge the fact that customers are less loyal to brands and dealers overall. 46 percent of new car customers consider three to four brands before buying a car.

Need for action

Customer experience and technology applications: In order to insure a high brand loyalty future retailers need to create a strong experience for their customers, making them irreplaceable. Technology applications such as Virtual & Augmented Reality can help to create a digital showroom enabling the dealers to present countless configuration options and respond to individual needs. At the same time digital touch points will move the dealer location closer to the customer in urban areas since the virtual showroom does not require huge spaces.

New mobility

85 percent of the surveyed dealers expect that the topic ‚full-service provider‘ gains importance. For customers one in three consider car sharing to be an alternative to owning a car.

Need for action

Mobility Provider: Dealers need to transform themselves more as mobility service providers in collaboration with OEMs and establish a customer focused Point of Contact concept to provide a personalised customer experience. Therefore, employees will have to become customer and mobility advisors and no longer purely sellers of products.

Download study now

The Future of Automotive Retail

Outlook

Customers expect to buy their future cars online

Customers, inspired and influenced by their experiences of other industries, expect at the very least an equivalent experience of the car trade. Very soon, car buyers are going to expect manufacturers and dealers to offer convenient, transparent and dynamic concepts that allow them to select and buy their new cars online.

Future challenges put the automotive industry’s retail model under pressure

Dealers will be required to take relevant actions in adjusting their current business model

The automotive retail sector in Germany will look substantially different in the next 10 years

Dealers will remain relevant but need to adjust their business model due to a changing market environment. This evolution has been in progress for some time now. We expect the role of the dealer to undergo a substantial change with a clear trend towards selling more services.

Therefore dealer needs to become more customer-focused especially when it comes to physical retail touchpoints. ‘Point of sale’ stores need to develop into ‘point of contact‘ stores where personal advice to customers is of primary importance alongside brand experience elements to provide a truly personalised customer experience.

Over the next five to ten years the role of the dealer and the current dealer franchise system will be called into question, with OEMs selling direct to customers. So far, OEMs are only testing direct sales and many challenges remain, particularly the legal situation and identifying the right pricing strategy. But as soon as these challenges are ironed out, the specific role of the dealer must be redefined.

Download study now

The Future of Automotive Retail

Interest aroused?

Contact our experts