Transactions stable, deal value significantly up: European private equity is recovering, as shown by PwC’s latest Private Equity Trend Report.

Your expert for questions

Florian Noell

CVC Center of Excellence at PwC Germany

Tel: +49 30 2636-4176

E-Mail

For any company seeking to compete globally and stand out from its competition, innovation is crucial. Increasingly, global champions are turning to external sources of innovation to drive their business forward. While their own research and development activities remain important, new market entrants are often quicker to achieve success with major innovative leaps forward.

Established companies are increasingly opting to collaborate with up-and-coming startups and profit from younger technological pioneers. Compared to other forms of collaboration, one aspect is noteworthy: worldwide direct investment by companies in startups has tripled in the years between 2014 and 2019. What's behind this trend? Companies can pursue two objectives through their corporate venture capital activities: financial yields and strategic returns. Focusing on the latter category, in particular, is increasingly enabling companies to gain access to future technologies, digital talents and expertise (for example, new markets and business models). For many companies, this represents a major step towards securing their own ability to thrive in the future.

The experts at PwC's Center of Excellence for Corporate Venture Capital (CVC) help you to seize opportunities arising from investing in innovative startups. Our NextLevel initiative aims to leverage our strong position in the ecosystem to build bridges between (Corporate) Venture Capital, young tech companies and family-owned businesses and corporations. Our mission is to support innovation drivers with a holistic view, from strategy to execution.

“I'm confident that by working together, today's market leaders and startups can bring about the most successful innovations.”

CVC investments in Europe 2023

Total number of deals in Europe in 2023

Average deal size in Europe in 2023

Annual percentage of deals in early-stage globally

Source: CB Insights – The State of CVC 2023 Report

The global trend towards increasing CVC activities and deals has also hit Germany: the CVC ecosystem has evolved significantly since 2004. More than 137 corporate venture capital companies are actively investing in Germany.

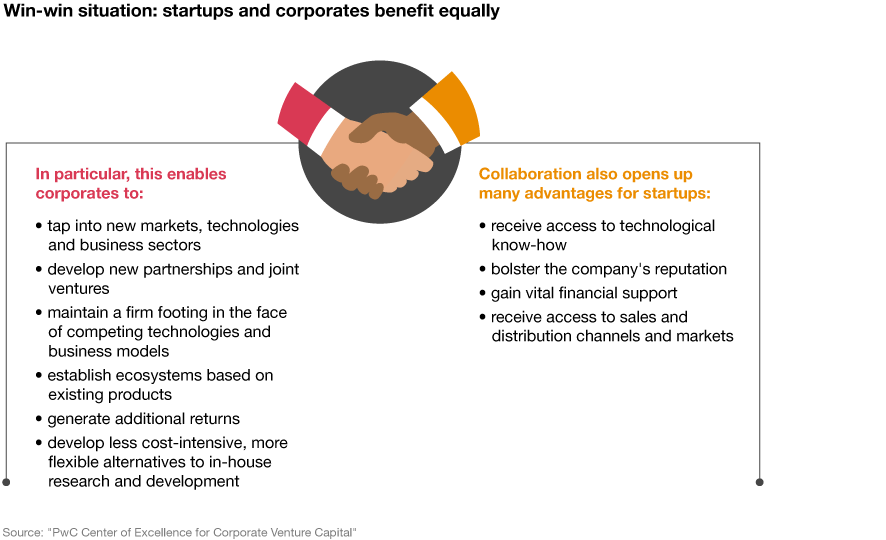

By collaborating with startups, established companies can generate a large number of advantages for themselves. Yet, the startups also benefit from cooperating with experienced entrepreneurs – making this a classic win-win situation.

PwC supports businesses looking to invest in startups and establish their own corporate venture capital unit in four areas:

Which opportunities does corporate venture capital hold in store for our current business and and what is the available budget? What are the primary objectives and focus of investment? How do investments in startups fit with our strategy?

Companies have to ask themselves a range of questions to find the CVC strategy that suits them best. PwC's experts will help you to find the right answers so your CVC unit can be successful in the long run.

Get to know PwC's team who will help you invest in innovative startups to shape the future together.

Our experts have a vast range of know-how when it comes to advising startups and corporate venture capital units. We bring together experienced companies and entrepreneurs and thereby foster innovation.

“Even if it doesn’t seem like it in these times of crisis: I’m confident that the future offers attractive opportunities for strategic business investments in startups.”

Transactions stable, deal value significantly up: European private equity is recovering, as shown by PwC’s latest Private Equity Trend Report.

PwC’s Global Centre of Excellence for Corporate Venture Capital helps you to identify VC funds that best fit your strategic objectives.

PwC-Studie 2023: Trotz Krise – Startups behaupten sich als Innovationsmotor.

How successful European companies create value with venture investments.

PwC's Next Level team provides answers to what is happening out there; to what drives you and your business. We rethink business models, help you to identify potential and enable growth. As the one-stop shop for innovation, our experts will guide you on your individual path to growth and change.

With our Global CVC Roundtable Community, we offer CVC units from around the world a platform for exchanging experiences. As part of regular virtual meetings our members discuss current market trends, best practices, but also challenges.

Global Venturing & EMEA Startups, Scaleups Leader, PwC Germany

Tel.: +49 160 90591673