Deal Announcement 07/21: Industrial Products

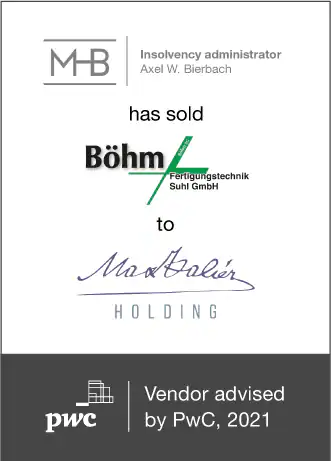

PwC acted as exclusive financial advisor to insolvency administrator Axel W. Bierbach on the sale of Böhm to Max Valier Holding GmbH

The Deal

The PwC M&A team is pleased to announce the successful sale of Böhm Group (“Böhm”) to Max Valier Holding GmbH (“Max Valier”).

Böhm, with its core operating entity Böhm Fertigungstechnik Suhl GmbH, is a well-known German supplier of customized mechanical and plant engineering solutions. As a one-stop system supplier, Böhm provides design, manufacturing, assembly, and after-sales services. Böhm’s products are used in various industries including the metal processing, automotive or packaging sector. Böhm has also successfully developed sophisticated own-branded machines for sludge drying and marble processing.

While Böhm reached attractive pre-COVID sales and profitability levels, the pandemic caused a significant demand shortfall. Consequently, Böhm Fertigungstechnik Suhl GmbH had to file for insolvency.

Axel W. Bierbach of Müller-Heydenreich Bierbach & Kollegen was appointed as insolvency administrator for Böhm Fertigungstechnik Suhl GmbH and initiated a structured, international sale process which was led by PwC M&A. In the course of the investor process, Böhm was sold to the industry holding Max Valier.

The asset and share purchase agreements were signed and closed in March 2021. Almost 180 jobs (including apprentices) were secured through the transaction. For a socially compatible personnel downsizing, an employment transfer company was set up.

Böhm

Böhm, headquartered in Zella-Mehlis, was founded in 1991 and emerged from VEB Carl Zeiss Jena and its production facility for measuring technology and plant engineering. Böhm has specialized in tailor-made mechanical and plant engineering solutions. In addition to its operations in Germany, Böhm also runs a production facility in Slovakia. Before filing for insolvency Böhm generated sales of more than €30m and employed a total of approx. 240 people, making it one of the largest industrial companies in southern Thuringia.

Müller-Heydenreich Bierbach & Kollegen

The law firm Müller-Heydenreich Bierbach & Kollegen (www.mhbk.de) is a partnership of attorneys in Munich and other Bavarian cities that has been specializing in restructuring and insolvency administration for many years. A total of six insolvency administrators handle insolvency proceedings at several local courts in Bavaria and Thuringia. In addition to transferring restructuring, the law firm’s particular strengths include insolvency plan proceedings, self-administration and group insolvencies.

Max Valier Holding GmbH

The industry holding Max Valier is specialized in the acquisition and development of medium-sized engineering, manufacturing, and service companies in the commercial and industrial sectors. Through deep technical understanding the Max Valier Holding is able to identify essential company and market potentials and offers attractive and tailor-made succession solutions for owners. The strategy of Max Valier Holding follows long-term investments in well-established companies, the promotion of innovation as well as modernization. The team of Max Valier Holding supports the acquired companies in expansions in order to take a sustainable leading position in selected future markets.

PwC

The global PricewaterhouseCoopers network is a worldwide association of independent auditing and consulting companies which together employ more than 280,000 people in 157 countries. Our global network comprises nearly 1,600 M&A professionals all over the world, realising approx. 400 successful transactions per year. We specialize in a wide range of independent M&A services including advice on acquisitions and disposals, mergers, public takeovers, privatizations as well as structured financing.

The transaction was led by Timo Klees (Partner) and Fabian Dalka (Senior Manager) and supported by Florian Middelkamp (Senior Associate).

Contact us

Partner, Head of Corporate Finance | M&A Distressed & Special Situations, PwC Germany

Tel: +49 151 10060451

Alexander Knögel

Partner, Corporate Finance | M&A Industrial Technology & Business Services, PwC Germany

Tel: +49 170 2250409