Corporate Venture Building

Your expert for questions

Alexander Rösch

Lead Corporate Venture Building at PwC Germany

Tel: +49 173 7067401

Email

Create your new venture!

In an era of rapid change, corporate venture building is at the heart of business evolution. Innovation is no longer just a “nice-to-have” but the crucial driver of a company’s success.

Corporate venture building enables established companies to transform ideas into successful, independent companies that combine the agility of a startup with the resources of a large enterprise.

This innovative strategy allows companies to respond to the latest market dynamics and developments and actively shape their future.

The advantages of PwC’s corporate venture building approach

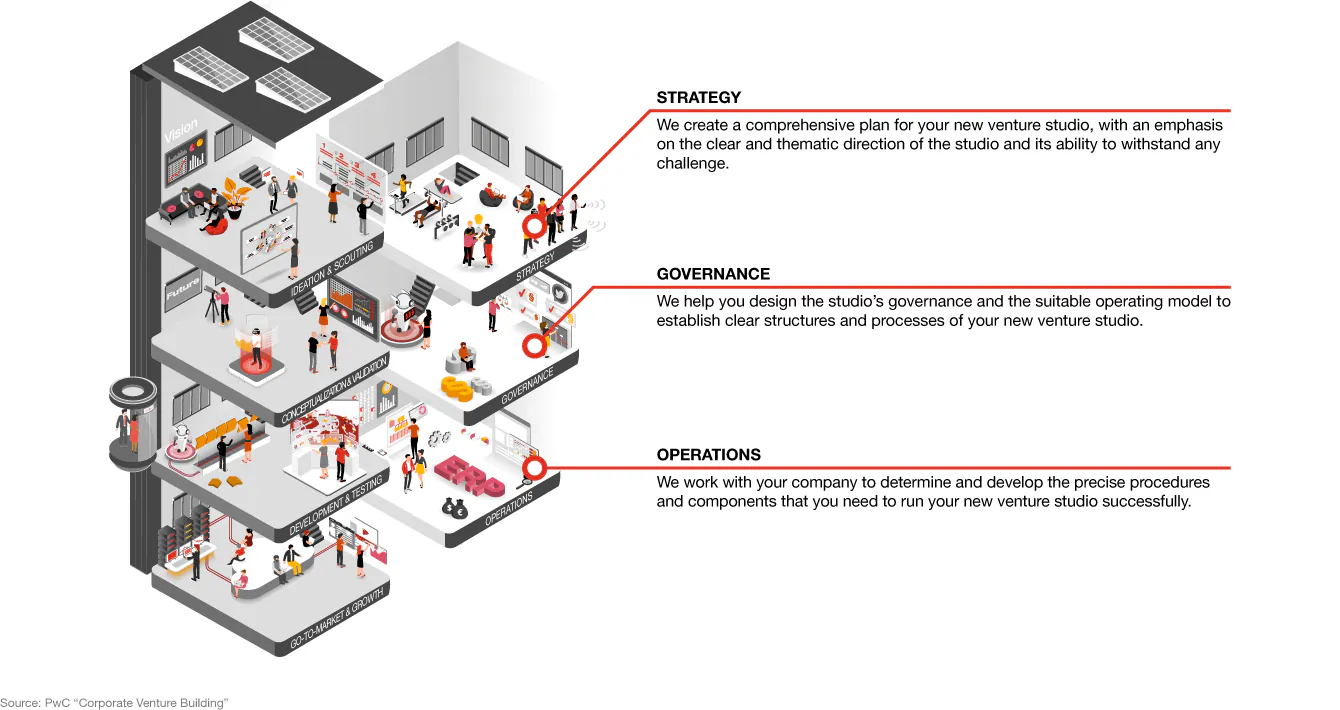

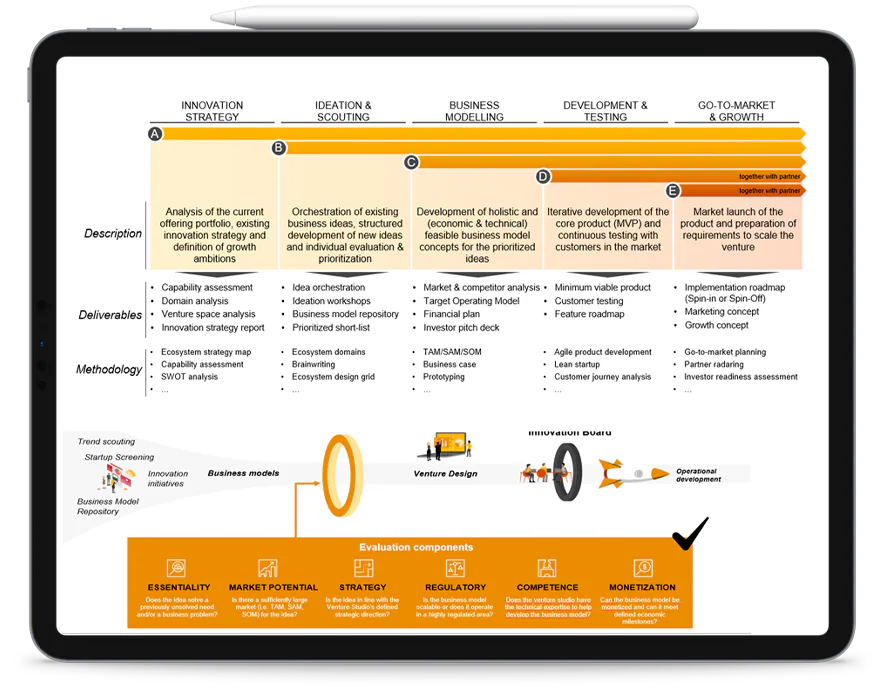

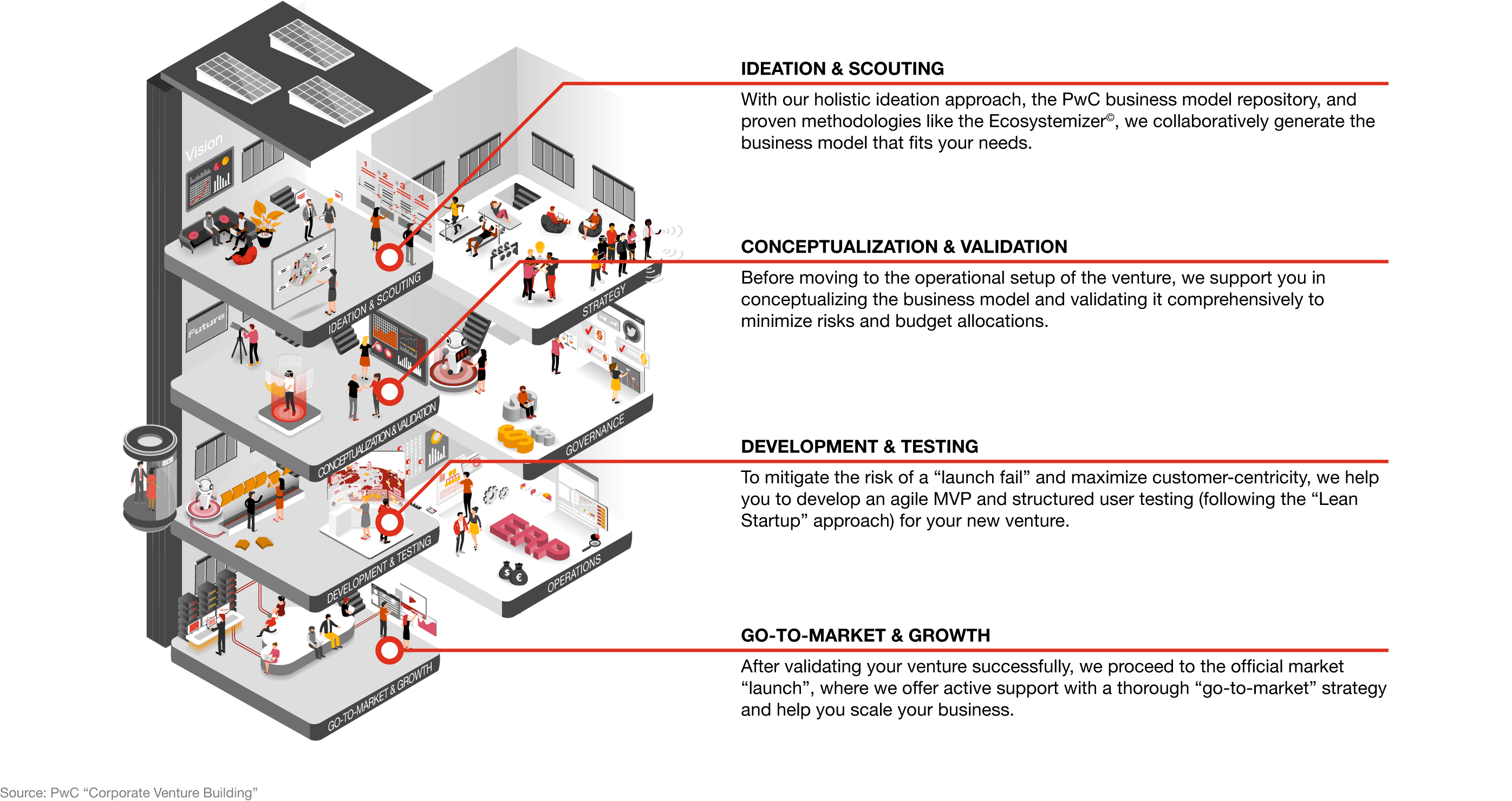

Take the first step with PwC Germany: Our services at a glance

We are your dedicated team to support you in exploring new markets, leveraging cutting-edge technologies, developing your ideas and business models, and creating additional revenue streams.

Venture Development

Venture development helps you create new business models through separate ventures without impacting your main business. Corporate venture building requires strategic structuring, founding skills, and industry-specific knowledge.

Our experts know the trends of different industries and will use their experience to build efficient structures and successful ventures with you.

Do you have any questions?

Contact us

Create win-win-situations with PwC’s venture building approach

Create new income, diversify your business, and boost your core offerings with corporate venture building. Use your current resources to strengthen your market position and develop new and cutting-edge solutions.

PwC Germany helps you with profound expertise, a global network, and extensive venture building experience. We lower risks for your new business and improve capital deployment, so that you can achieve your ambitions and avoid scatter losses.

“Venture building enables companies to diversify their portfolio, unlock new revenue streams, and actively drive disruptive innovations.”

Current projects and case studies

- Automotive

- Energy & Public Services

- Financial Services

- Insurance

- Retail & Consumer

Automotive

Background: A global automotive OEM plans to transfer an internal “direct-air-capturing” project to a new external company to facilitate faster growth in the future and attract external investors.

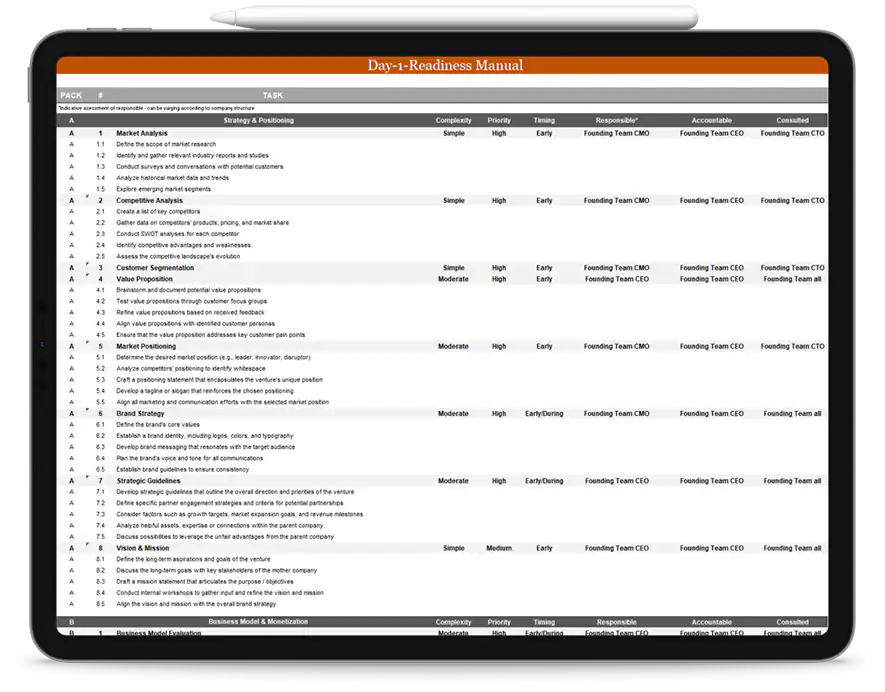

Result: Development of a manual for operationalizing a spin-off, considering strategic, tax-related, legal, and procedural aspects, as well as an assessment of these in terms of complexity, priority, and timing.