If industrial companies want to keep up with global competition, they must develop innovative, customer-focused products and services at ever shorter intervals. The PwC study “Digital Product Development 2025 – Agile, Collaborative, AI Driven and Customer Centric”, details what separates Digital Champions from other businesses in terms of digital product development. What is the role of data analysis and artificial intelligence? What do these companies use digital tools for? What is the state of Cyber Security? Our study answers these questions and more.

Download study „Digital Product Development 2025“, PDF (1,8 MB)

This is a modal window.

“Increased investment in research and development does not automatically lead to greater success. It is more about strategically smart use of resources.”

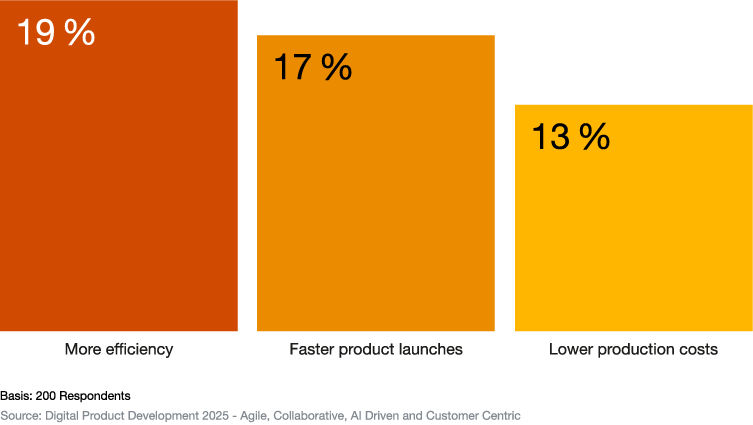

Investing in the development of digital products is expected to increase the efficiency of industrial companies by, on average, 19% over the next five years. It should also reduce time to market by an average of 17% and production costs by an average of 13%.

The study shows that companies who are digital champions – 10% of those surveyed – do invest more in digital product development. However, most of them achieve better results while spending less than 4% of their revenues on research and development – which is less than the 1,000 most research-intensive companies worldwide.

Which advantages do industrial companies expect from investing in digital product development?

Tailor-made products, matched to individual customer needs, are key drivers of revenue. Leading companies achieve a high degree of personalisation with products that feature simple functionality, good durability or improved user interfaces. The greatest challenge is to achieve this at the same time as optimum cost efficiency.

For this reason, Digital Champions integrate customer focus into the development process at an early stage, and work closely with partners. They also plan to significantly increase the development of individually tailored products and services over the next five years. They expect their proportion of personalised solutions to grow by 26% within this period – more than double the average of all the companies we surveyed, and 13 times more than the least digital companies.

How much will the share of personalized products increase in the next five years?

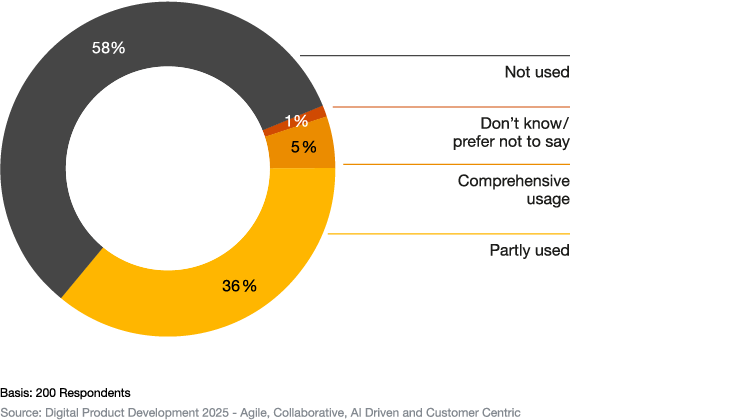

One of the study’s key findings is that 41% of the companies surveyed use data analytics and artificial intelligence (AI) for at least part of the digital product development process. However, only 5% use these technologies comprehensively, for example in applications such as process and quality optimisation or to validate products and services.

Digital Champions not only use algorithms for analysis, but also focus strongly on the underlying data models. This enables them to look at the whole product lifecycle, and to work with external providers and customers throughout the development process.

Usage of Data Analytics and Artificial Intelligence

“A company that wants to deliver customer-focused products can no longer do without digital tools and capabilities, such as artificial intelligence and data analytics.”

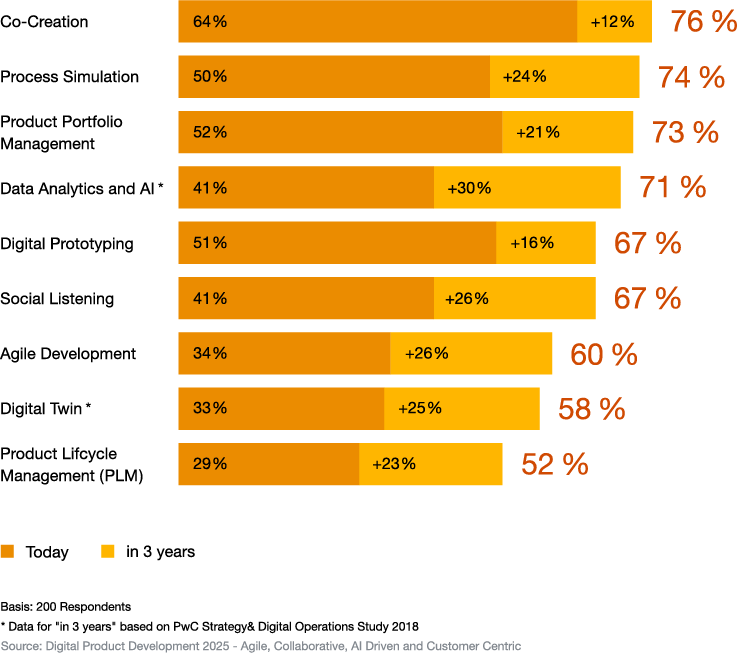

Looking at digital tools makes one thing clear: many companies are already using at least some selected technologies for digital product development. Almost two thirds of the companies surveyed use tools for co-creating products and services internally or with external partners. Half use digital technologies for process simulation and the development of digital prototypes.

Over the next three years, industrial companies primarily want to focus on expanding their data analysis and artificial intelligence capabilities (plus 30 percentage points), agile development methods and social listening (each plus 26 points) and also the use of digital twins (plus 25 points).

Industrial companies’ increased use of data analysis and artificial intelligence for product development also heightens the importance of cyber security. According to the study, there are great deficiencies here: 71% of respondents have non-existent or inadequate protection mechanisms against cyber attacks.

The Digital Champions are at an advantage here: more than half have made IT security at least an integral part of their project management approach. Yet almost none of the companies we surveyed are implementing comprehensive strategies based on cataloguing and prioritising risks – not even the leaders.