PwC launches ECA Advisory Practice for Capital Projects

15 January, 2018

PwC has established a group of experts focusing on the feasibility of capital projects covered by export credit agencies (ECA). The newly formed team supports and assists ECAs in their decision making process on providing export credit guarantees for capital-intensive projects. Heiko Lentge and Alexander Wuermeling, both ECA experts, are the leaders of the ECA Advisory Practice for Capital Projects. They both have 15 years of experience in assisting all major ECAs. In the following interview, they talk about the future role of ECAs – and in which areas their team can offer advice.

Why are export credit agencies getting more and more important?

Heiko Lentge: Until 2020, more than 4.5 trillion US dollars will be spent globally on infrastructure every year. We expect this figure to further increase in the following decade. ECAs will play a major role in enabling long-term financings for capital projects and project financings. Demand for long-term financings will likely surge, especially in project financing.

What are the challenges for ECAs in this context?

Alexander Wuermeling: ECAs will have to look at many large projects over the next years. In order to provide cover, ECAs need to demonstrate to their respective boards that the project is feasible and viable from a commercial and documentation related perspective. This results in an extensive due diligence process. Coming to a conclusion on the projects feasibility is not an easy task for the decision-making bodies of ECAs. In recent years, we have seen that ECAs have started to streamline their organisations. They tend to outsource processes, in particular for capital projects.

How can your newly formed team offer support?

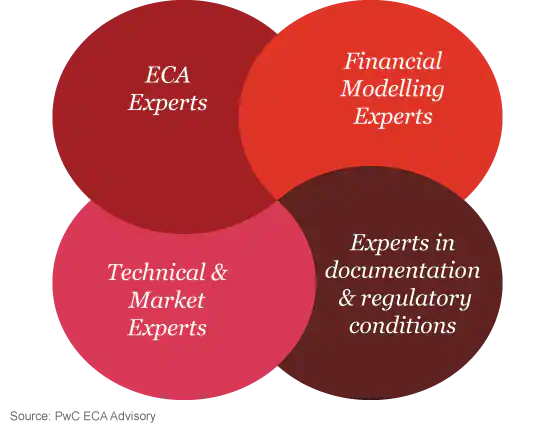

Lentge: This is exactly where our new practice comes in. We look at the situation from the perspective of ECAs and asked ourselves what kind of support we can offer as a global organisation with more than 240,000 employees. ECAs need to evaluate market, financial, documentation related, and technical risk elements of capital projects. With our ECA Advisory Practice, we offer a team combining PwC’s best practice professionals in each of these categories.

What are the success factors when analysing complex transactions?

Wuermeling: It all comes down to having the right people. This is why we bring together the most experienced ECA experts, the most talented financial modelling specialists, highly specialized commercial and market consultants from PwC's Strategy& consulting team, technical experts for capital projects from PwC’s CP&I team as well as specialized project finance lawyers.

What differentiates your team from other experts?

Lentge: Projects take place all over the world and in various industries. This is why regional experience and industry knowledge is key for the feasibility analysis of ECA-covered projects. With our new practice, we are in a position to give clear recommendations and precise analysis to ECAs. PwC is a very credible firm that can provide ECAs with a high level of confidence when making their decisions on providing cover for capital projects.

Why did you decide to launch your practice group now?

Wuermeling: We have seen that projects are becoming more and more complex. This is true for all sorts of projects: wind farms, power plants, refineries, gas pipelines, LNG plants or mining projects, just to name a few. It takes time to agree on all commercial and documentation related issues and get the financing in place. As a result,we have noticed an increasing demand for feasibility, coordination and due diligence support from ECAs. At the same time, we see a higher demand for supporting and assisting ECAs during the financing process for large-scale projects. Our ECA Advisory Practice for Capital Projects is in a very good position to service ECAs located in different time zones on commercial, market, technical, documentation related and financial model related aspects of specific projects.