Towards a successful thermal energy transition in Germany

Global demand for heating is increasing as population growth continues and people want to improve their quality of life: around half of global final energy is already used to generate heat for private households or industrial plants. Unlike electricity, renewable energy still plays only a minor role in global heat generation. Just 10 percent of heat generated worldwide comes from renewable sources.

The study “Opportunities and risks for Germany’s heating industry in a competitive global environment” sets out the contribution that heat pump technology – and the German heat pump sector in particular – can make towards achieving global climate goals. Its authors also show why Germany needs a thermal energy transition for a successful energy transition – and examine the political and legislative frameworks that are still holding the industry back in Germany.

Overview of the study

Sales of heat pumps are rising fast

The technology is in greater demand than ever: global demand for heat pumps was up 10% in 2018. Global sales were $48bn in 2017, and market analysts predict this will almost double by 2023 to $94bn. The boom is primarily being driven by the fact that the technology is efficient and clean – and can be used to significantly reduce greenhouse gas emissions (GHG emissions).

Accordingly, the International Energy Agency (IEA) expects sales of heat pumps to reach 33 million by 2025 and almost 60 million by 2030.

Europe’s market share is small compared to Asia and the USA

Regional drivers of global heat pump sales are Asia (particularly China and Japan) and the USA: over 80% of new heat pumps were installed in these countries in 2017. Politicians offered tax exemptions and government incentive schemes to encourage the spread of this environmentally-friendly technology.

In Europe, however, just 1.3 million systems were installed in 2018, mainly in Scandinavia. There were 11.8 million heat pumps in Europe in 2018. The European Heat Pump Association (EHPA) therefore believes that the technology has great potential: it estimates potential annual sales of 6.8 million units and a potential total stock of 89.9 million heat pumps.

Huge potential in existing buildings

Growth in Germany has been at a very low level so far, even compared to other European countries: there were just 2.3 heat pumps installed per 1,000 households in 2017. By comparison, the numbers for Norway and Sweden were 34.3 and 22.7, respectively.

However, installations of heat pumps in new buildings are on the rise in Germany. Heat pumps accounted for 43% of heating systems in the new-build market in 2017, higher than conventional gas-fired heating systems for the first time. However, heat pumps still account for just 6% of replacement heating systems in existing buildings. This is where most new heating systems are installed, so existing properties can make an even larger contribution towards achieving climate goals. Since heat pumps have barely figured in replacement of heating systems so far, there is still huge untapped potential for reducing emissions from heating.

Heat pumps offer strategic benefits

Increasing roll-out of heat pumps on the German market – for example, to the same level as in Sweden (22.7 heat pumps sold annually per 1,000 households) – would not only protect the jobs of the 75,000 people employed in the industry, but also secure local value creation. This is because most German heat pump manufacturers are mid-sized companies, a number of which are located in rural and sometimes deprived regions.

A strategy for ensuring widespread use of heat pumps would also offer other benefits:

- Alleviating the backlog of refurbishment going back several years

- Increasing the share of renewable energy in the heating market

- Supporting companies and tradespeople working on building renovations (an industry with around 540,000 employees)

- Enabling owners of local solar panel systems affected by the phasing out of EEG funding and falling feed-in tariffs to use locally generated electricity to operate a heat pump

- Making it easier to use heat pumps over the medium term for sector coupling, helping to bring about digitalisation in the energy transition.

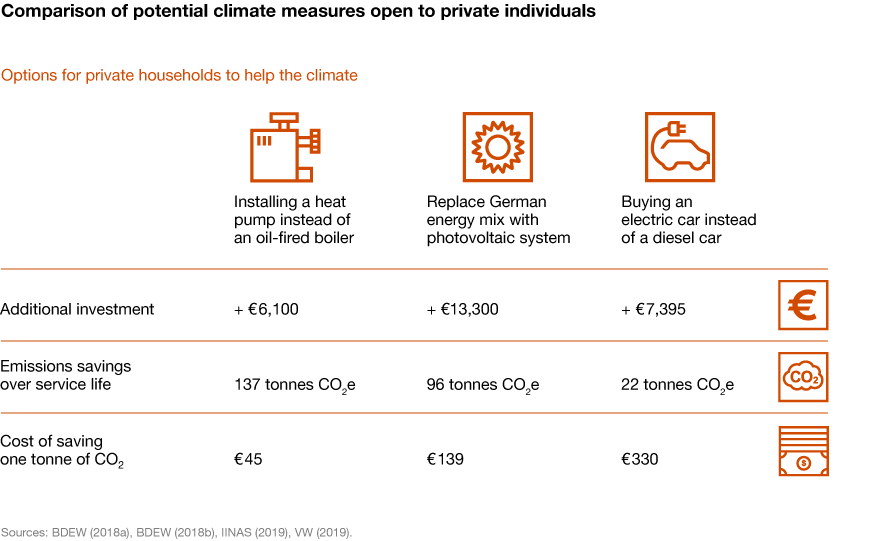

The thermal energy transition does not require high levels of investment

The heating sector accounts for a large share of final energy needs, which means it has huge potential for reducing greenhouse gas emissions. But the authors of the study note that this potential remains untapped for several reasons:

- Final energy needs and heating requirements are not being reduced

- Conversion to useful energy is still too inefficient

- Too little renewable energy is being used for heating applications

Heat pumps are a mature technology that can be used to tap this potential in the short term, and they do not require high levels of investment.

Nine recommendations for decision-makers

Increasing installations of heat pumps is advisable – and much needed – in terms of both climate and energy policy. The study’s authors propose new measures for increasing the roll-out of this technology and speeding up achievement of both international and German climate goals.

1. Factor GHG emissions into energy pricing

The prices for natural gas, fuel oil or electricity used to produce heat do not take account of the level of emissions caused. The prices therefore do not incentivise the use of low-emission energy sources.

Energy sources should therefore be subject to costs based on the emissions they cause. The planned carbon pricing system is a step in the right direction, but is not enough to ensure that actual emissions are fully factored in.

2. Reverse the one-sided policy of taxes and levies on electricity

In Germany, fuel oil and natural gas are currently subject to lower taxes and levies than electricity. This is because the costs of the energy transition have mainly been passed on to the price of electricity; hardly any have been passed onto fuel oil or natural gas. As a result of this, the price for heat pump electricity is three times that of fuel oil or natural gas.

The costs of the energy transition therefore need to be shifted from electricity to fuel oil and natural gas, in order to factor in the climate compatibility of these heat sources more effectively.

3. Tighten up requirements for energy efficiency and renewable energy for new buildings and existing building stock

Tightening up requirements on energy efficiency and the use of renewable energy could increase the use of heat pumps, making a major contribution to the security of supply, environmental compatibility and affordability of the German energy supply system. Statutory guidelines on new buildings and renovation/upgrading of current building stock also affect which heating system is selected.

The mandatory minimum quota of renewable energy in existing housing stock should therefore be extended.

4. Set an expansion pathway for the heating sector

The German government has pressed ahead with the expansion of renewable energy in the electricity sector with a clear strategy and long-term goals. Investments in the heating sector are similarly long-term and involve launching new technologies on the market, or increasing the use of these technologies. As a result, this sector also needs a rigorous strategy.

The current funding programmes for heat pumps – run by the Federal Office for Economic Affairs and Export Control (Bundesamt für Wirtschaft und Ausfuhrkontrolle, or BAFA) and the Kreditanstalt für Wiederaufbau (KfW) – could be formally linked to an expansion pathway defined by legislation, as with funding for photovoltaic systems under the EEG.

5. Raise awareness among stakeholders and decision-makers

There are various stakeholders who have an influence on take-up of low-emission heating technologies and on which specific systems are installed. Politicians exert this influence using energy pricing, legislation and incentive schemes. Private, business and public-sector consumers make decisions based on economic efficiency and environmental protection. Energy consultants, tradespeople and chimney sweeps are also involved in making the decision to purchase.

Stakeholders need to be kept informed about the suitability of climate-friendly technologies and the options available to support the thermal energy transition in Germany.

6. Standardise planning application process at state level

Heat pumps that obtain heat from water or the ground will often require planning permission and are sometimes subject to special conditions. Obtaining permission is not only time-consuming and costly, but the process varies from one German state to another. This increases bureaucracy and reduces certainty around planning.

The planning requirements need to be reviewed across all German states and then standardised to remove the obstacles to installing heat pumps.

7. Promote and fund sector coupling

Networking the electricity, heat and transport sectors will drive up the proportion of renewable energy and help to compensate for the fluctuations in electricity supply from wind and solar power. Stepping up coupling of the electricity and heating sectors in particular needs to ensure that more low-emission, electrically powered heating technologies are installed: heat pumps generate heat when the amount of electricity supplied is high, and use stored heat when it is low.

Sector coupling needs to be expanded by undertaking grid expansion and promoting combined, decentralised heat and power generation, as well as rewarding flexible consumers.

8. Roll out heat pumps together with insulation

Renovating buildings is central to the German government’s climate goals. There are two benefits of investing in insulation and replacing windows: they enable energy savings to be made over the long term, since they reduce a building’s heat requirements, while work on the building envelope also provides an opportunity to replace the heating system. However, the German renovation business is continuing to stagnate due to the high investment costs and uncertainty over future energy pricing and potential regulatory changes.

More funding should be allocated for planned, cost-optimised insulation measures to forestall stagnation in the renovation business.

9. Improve the operating framework for the domestic market

There is a correlation between the energy price ratio and the use of heat pumps: in the Scandinavian countries, for example, the price of electricity is low relative to fuel oil, and heat pumps have boomed. Policy measures and market incentive programmes have also helped to make heat pumps highly affordable for private consumers.

More use should be made of best practice from other countries (such as market incentive programmes) and from other industries (such as e-mobility).

Methodology

The study was compiled by the auditing and consulting firm PricewaterhouseCoopers (PwC) for the Bundesverband Wärmepumpe e. V. (BWP).

Contact us

Contact us