Your expert for questions

Till Hannig

Tax & Legal Insurance Leader at PwC Germany

Tel.: +49 40 6378-2640

Email

Tax departments are involved in most operational processes

Tax departments at insurance firms usually work on determining taxes and preparing tax returns, reports and balance sheets. Along with these key tasks the department's expertise is also applied to other operational business processes. This is particularly common when setting up permanent branches and subsidiaries (88 per cent of the companies surveyed), for M&A transactions (84 per cent) and for capital investment decisions (76 per cent). These are some of the findings of our quantitative and qualitative study 'The Tax Function in the German Insurance Industry – Where Is It Headed?' which was conducted among around 100 German companies from all sectors of the insurance industry. According to this study, tax experts are less often involved in documentation and transfer pricing (62 per cent).

A further result of the study: the staffing levels in the tax departments sometimes vary considerably. While stock exchange listed and internationally active insurers have an average of around 27 employees working on tax tasks, locally based companies have only two to three employees.

An Overview of the Study

Governance Tasks are Increasing, Tax CMS is Becoming the Market Standard

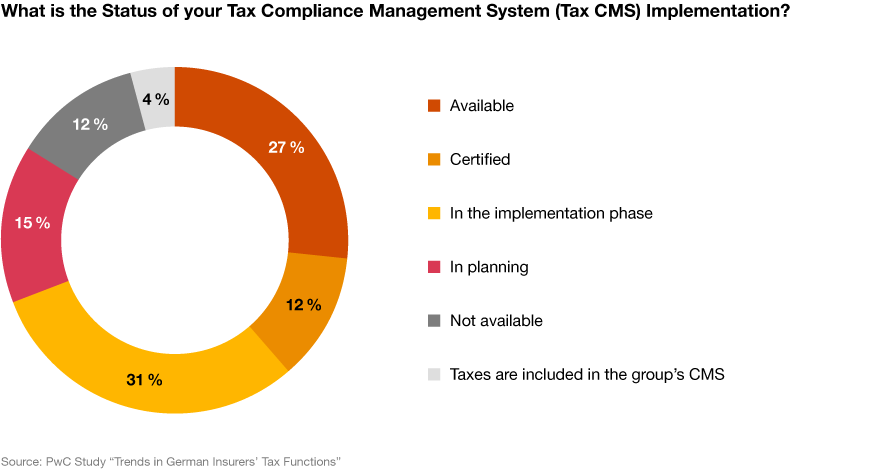

In addition to their core and specific support tasks, tax departments have in recent years been more and more involved with governance and regulatory projects. Dealing with these areas, which no longer requires only professional tax knowledge but also procedural expertise, has led to many insurers introducing so-called Tax Compliance Management Systems (Tax CMS). These systems can be used to define basic procedural framework conditions and document a tax strategy. Only about 11 per cent of the insurance companies surveyed have not yet implemented such a compliance system. All others have either already achieved certification (11 per cent), implemented a system (26 per cent), are in the implementation phase (30 per cent) or are at least in the concrete planning phase (18 per cent). Of those companies that already have a Tax CMS, about 40 per cent completed the implementation before 2018, and 60 per cent not until 2018 or later. Of the insurance companies that are not yet ready, around 80 per cent expect to have completed the implementation by the end of 2020.

"In the insurance industry the Tax CMS has become a market standard. Comprehensive certification of established Tax CMS has not yet happened. The number of certified enterprises may however strongly increase, since at present nearly 50 per cent are still in the implementation or planning phase."

Tax Departments are Becoming Ever More Digital

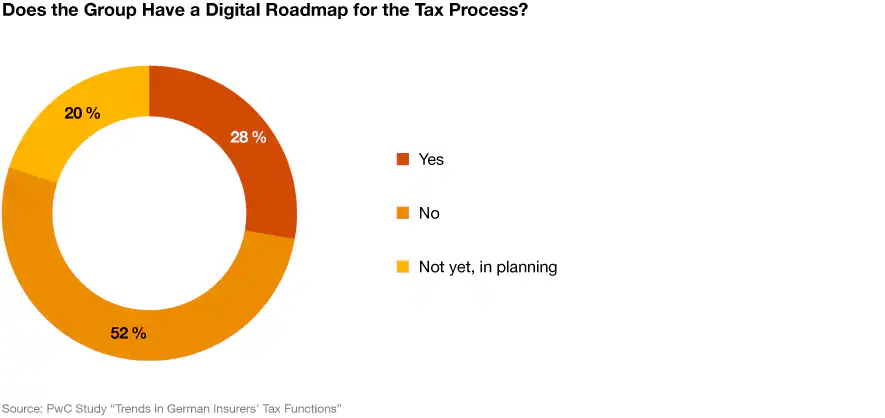

Digitalisation is another area that tax departments are increasingly concerned with. Just under 28 per cent of the insurance companies surveyed already have a "digital roadmap", while a further 20 per cent are still in the concrete planning stage. Efforts here are focusing on processes such as tax calculations, quarterly financial statements or tax declarations for operating taxes. In order to automate these processes to a greater extent, companies are making use of a wide range of different technologies and tools. In addition to the providers known on the market, they also use tools and software produced in-house by smaller IT service providers. A uniform IT solution for the vast majority of tax processes is rather the exception. In fact, it can be seen that companies are pursuing a "cherry picking" approach here and look specifically for suitable tools for different areas of application. To this end, a large number of insurers are in an ongoing exchange with internal and external IT experts. It is particularly noteworthy that two insurance companies have IT experts specifically assigned to the specialist department, who are charged with driving automation from within.

"The topic of digitalisation is omnipresent: even tax departments in the insurance industry are looking hard at this topic. The tools being used are very varied and there is a 'colourful' IT system landscape."

Tax Transparency and Sustainability – Topics for the Future

The increasing diversity of tasks in tax departments is a trend that is likely to continue. According to the study, future developments lie in the areas of tax transparency and sustainability. One indication of this is the publication of so-called tax transparency reports, which are currently published by four of the insurers surveyed and which three others plan to publish. These reports are prepared voluntarily and provide tax information that goes beyond the legally required level (e.g. in the context of non-financial reporting according to §§ 289b ff. HGB and §§ 315b ff. HGB). Up to now, however, only large, internationally active and capital market-oriented insurance groups have published such reports. However, due to the social relevance of the topic, it should also be of interest to other companies to regularly inform their stakeholders about tax-related activities.

The new reporting standard "GRI 207: Tax" of the Global Reporting Initiative (GRI) could accelerate this development. This standard aims to create a more open culture in tax matters and to report transparently and in a balanced way on the tax strategy of and payments by insurance companies. Although compliance with the standard is not mandatory, its introduction should exert some de facto pressure and encourage individual stakeholders (in particular institutional investors and NGOs) to demand even greater transparency.

Contact us

Contact us