China’s Social Credit System: Strengthening transparency and integrity - PwC China Compass

04 March, 2021

Ever since it was first announced, China’s Social Credit System (SCS) has been expanded and further developed. Following signing of the EU-China Comprehensive Agreement on Investment in December 2020, foreign investors doing business in China should pay particular attention to the ongoing implementation of the SCS and the implications it could have for their operations.

Since 2007, the Chinese government has been developing a national system to standardize the assessment of individuals’ and companies’ economic and social reputation (“social credit”). The system is intended to track and evaluate the economic and non-economic behavior of people and organizations, thereby enabling the government to better regulate markets and business in China. The SCS applies to both individual citizens and corporations. This article focuses mainly on corporations.

The system tracks economic and non-economic behavior

What is the Social Credit System?

The SCS is mainly comprised of three interconnected components:

- A master database: The National Credit Information Sharing Platform consolidates social credit data and facilitates data-sharing among government agencies.

- Blacklists and redlists: Blacklists are for individuals and companies violating regulations, redlists for those with excellent credit records.

- Unified punishment and rewards system: Different government authorities collaborate to penalize those with poor credit records (on blacklists) and reward those with good credit records (on redlists).

To better understand how the SCS works, let’s consider a real-life example. An international company operating in China was punished by the local environmental authority for its non-compliant behavior in the area of environmental protection. The company then submitted a bid for a government project, but was rejected by the local government in accordance with the interministerial memo that called for joint measures to be taken against the company and that deemed it a distrusted enterprise in the area of environmental protection.

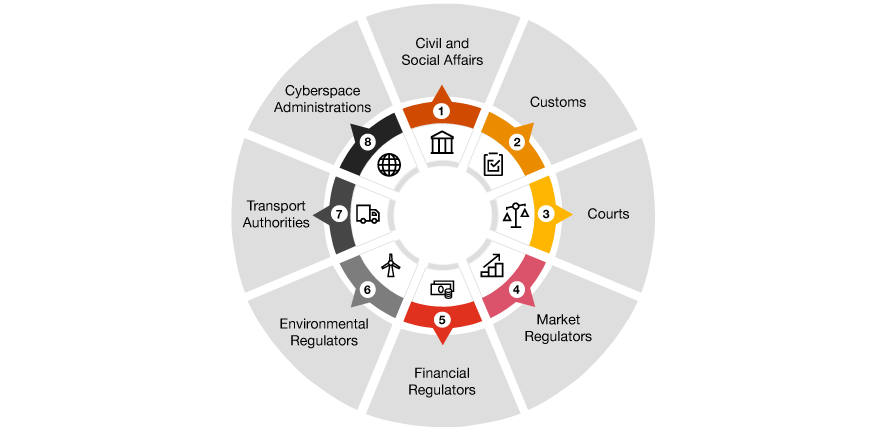

Here is a summary of the regulatory areas in which the relevant governmental institutions may enforce compliance:

How will the SCS influence multinational business in China?

Generally, all business entities registered in China are covered by the SCS, including subsidiaries, branches, joint ventures and other operations. Each government authority lays out its own measures (e.g. punishment) to be taken against companies which engage in non-compliant activities. It can lower their credit scores in the respective regulatory areas, or even put them on a blacklist, which could trigger joint punishment by other regulatory authorities. Similarly, businesses with favorable credit scores (i.e. those on a redlist) may receive beneficial treatment from the authorities for their operations, such as fewer government inspections and faster approval processes (e.g. for obtaining a business license or establishing a joint venture).

Since each government level (state, province, city) and different regions can lay out their own regulations and policies regarding the SCS, the possibility exists that government information on multinational corporations (MNCs) may be incomplete and discrepancies could exist across the regions implementing the SCS, making it difficult for MNCs to be fully compliant with it. What adds to the complexity is that the credit scores of various entities could also be affected by the personal credit ratings of top-level management such as board members and the credit scores of business partners such as suppliers.

A company’s score can be affected by managers’ personal credit ratings

At the same time, many uncertainties about the SCS must still be clarified. A few examples:

- To what extent will entities associated with MNCs be impacted by the SCS?

- To what extent will companies be affected by their business partners and key employees who are also listed in the SCS?

- Will all government and regulatory authorities ensure complete, accurate and timely data collection and processing?

- How and to what extent will companies’ confidential information be collected, processed, stored and protected?

- Will local governments apply the policy laid out by the central government in a consistent manner?

- What mechanisms are in place to rectify an incorrect rating?

How should companies prepare? A few practical steps to get started

The SCS clearly introduces a range of challenges that companies must address. However, it also offers an opportunity for them to review and refresh their internal and external compliance policies. Here are a few tips on how to proactively prepare and successfully enhance any changes that must be made:

- Acquire a better understanding of the SCS and stay informed of relevant announcements and developments regarding the system.

- Conduct impact analysis and even gap analysis to understand how and to what extent your company is impacted.

- Leverage internal and external resources to examine and remediate high-risk areas (e.g. key business partners) early on before problems arise.

- Take corrective action now against any existing negative ratings and blacklisting.

- Most importantly, take the opportunity to review and enhance your compliance process holistically. Review your key compliance areas – such as tax issues, the integrity of business partners, product safety and compliance, and environmental and social obligations – and proactively strengthen any weak spots.