Women in private equity are still underrepresented - but the sector is starting to change

27 October, 2017

The percentage of women working in the private equity sector is lower than in virtually any other industry. As shown by the special report of Preqin in cooperation with PwC, women account for only 17.9 percent of all employees in the sector. In senior management, this figure is only 9.6 percent. Even within the alternative investment classes, the sector is thus to be found at the rear of the field. However, it is now possible to make out initial specific signs of a cultural change.

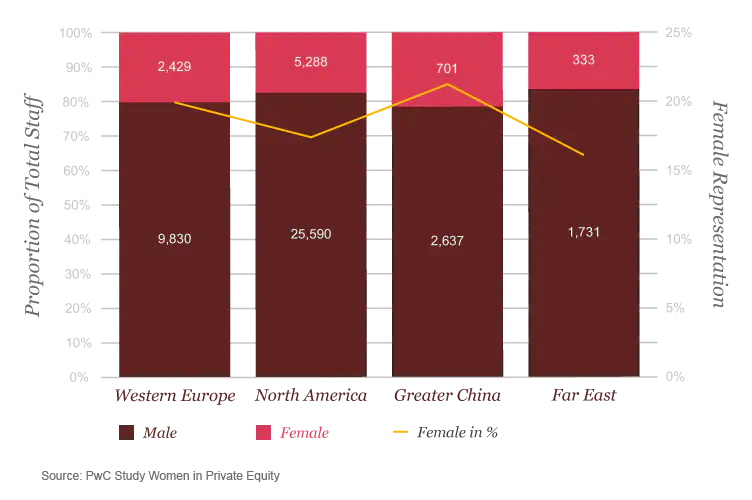

The number of 56,547 persons employed in the private equity sector world-wide includes just 10,114 women. However, the percentage of women, which is 17.9 percent world-wide, varies in the individual economic regions. For instance, there are above average numbers of women working in the sector in Western Europe (19.8 percent) and particularly in Switzerland (23.9 percent).

It is true that the overall percentage of women working in the investment sector is very low. However, the percentage of women working in the venture capital and real estate sector and at hedge funds is still higher than is the case in private equity companies. The report considers that one explanation for this situation is to be seen in the history of the sector which, since its beginnings in the 1980's and 1990's, has been very much dominated by men - and indeed, this is still the case today. Female role models are rare, such as for instance Hollie Haynes, the founder of the US private equity company Luminate Capital Partners, or Dominique Senequier, President of the private equity investment company Ardian which is located in Paris.

It is still the case that the sector is mainly managed by the overwhelmingly male founder generation. This structure is having a negative impact on the process of change in the direction of a corporate culture which integrates modern concepts of work-life balance and diversification as a matter of course.

The report also states that the relatively small size of private equity companies is one of the reasons why there is still a lack of part-time models which would enable employees to combine a career and family life more readily. The problem of lack of opportunities for promotion is clearly demonstrated at the management level: Only 9.6 percent of management positions are held by women.

For the companies themselves, traditional structures might become a problem in the long term if such companies are not very attractive for women. The pool of female applicants available to the sector is small. Investment companies have now recognized this problem, and are increasingly starting internal initiatives to promote talented female employees more strongly. Networks, forums and mentor programs for female managers are ensuring that there is a greater perception of the potential of women in the private equity sector, also across the entire sector.

The report concludes that it is vitally important that investment companies internally promote a cultural change which offers opportunities to talented female employees to position themselves better in the sector. Not only internal but also external considerations are important in this respect: This is because the market environment has also changed, also entailing changed requirements and expectations of employees and investors with regard to a modern company.