Six out of ten companies investing in tax compliance

Companies are reducing their liability and reputational risks by using internal tax compliance management systems (tax CMS, TCMS) in order to fulfill their tax-related obligations. In practice, companies, advisors and auditors interpret the details of requirements very differently. We therefore wanted to find out how far individual companies and groups with global operations have come with the implementation of tax CMS and whether standard approaches have emerged for the implementation of certain CMS requirements.

Overview of the study

Implementation gathering pace at German companies

Many of the survey participants need to catch up – some significantly – in their use of a tax CMS with only one in ten of the German companies surveyed stating they have already completed a tax CMS project. Nevertheless, six in ten companies are currently in the process of implementing their tax CMS. Almost two thirds of the survey participants (62 percent) believe that their tax CMS has reached a maturity level of 50 percent or less. Only 22 percent believe this level stands at 70 percent or more. A mere 1 percent of the survey participants believe that their tax compliance management system is 100 percent mature. When implementing a tax CMS it is necessary to think in the medium to long term and remember:

Anyone who focuses mainly on project costs rather than maturity level will end up losing money in the end. Anyone who scales their projects too small will often face additional work in their day-to-day business as well as time-consuming and costly follow-up work as the years go by.

Many companies are still too hesitant about implementing a tax CMS. It is therefore a welcome development that many have already started with gradual rollouts.

More than half (52 percent) of survey participants stated that they have thus far achieved at most 50 percent of their defined objectives for tax compliance. Moreover, one in ten companies stated that they have not even reached any of their objectives in relation to tax compliance. The majority of survey participants stated that the largest hurdle to doing so was insufficient staff numbers and IT resources. This primarily relates to small and medium-sized enterprises.

DAC 6 often not taken into account yet

Only 4 out of 10 companies (38 percent) believe that their risk identification process is good or very good with a view to identifying all relevant – but not too many – risks. It is also notable that almost half of the companies surveyed have not yet taken the EU requirements arising from the Directive on Administrative Cooperation 6 (DAC 6) into account in their tax CMS. With DAC 6, the European Union has introduced retroactive reporting obligations for cross-border tax planning. Breaches of the reporting obligations will result in an entry into the German Central Commercial Register (Gewerbezentralregister), meaning that companies will be excluded from public contracts for approximately five years.

Violations of DAC 6 can have a very acute impact on companies. It is therefore concerning that only about half of the survey participants have thus far implemented effective controls for tax compliance.

Incomplete GoBD procedure documentation

Companies use GoBD procedure documentation to demonstrate that they fulfill the Principles for the Proper Management and Storage of Books, Records and Documents in Electronic Form as well as Data Access (Grundsätze zur ordnungsmäßigen Führung und Aufbewahrung von Büchern, Aufzeichnungen und Unterlagen in elektronischer Form sowie zum Datenzugriff – GoBD). Here, a total of 80 percent of surveyed companies responded that they do not yet have GoBD procedure documentation in place for either all (45 percent) or any (35 percent) of their tax-relevant data processing systems.

This result is very concerning because it means that eight in ten companies, strictly speaking, cannot demonstrate that they have an effective tax CMS.

VAT of particular relevance for companies

With regard to types of tax, all survey participants singled out VAT as the most relevant tax form. 18 percent of survey participants have already completed their tax CMS implementation for VAT and 63 percent have already started implementation.

Contrasting this, 50 percent of corporate groups with global operations state that the topic of customs is not relevant to their tax CMS. This might be due to the fact that responsibility for this topic lies with units other than the tax department within these companies – or perhaps that many companies underestimate this topic.

Methodology

For this study, we surveyed more than 150 companies from more than 15 sectors, ranging from individual companies with annual turnover of less than € 100 million to corporate groups with global operations and revenues exceeding € 10 billion.

Individual CMS benchmarking

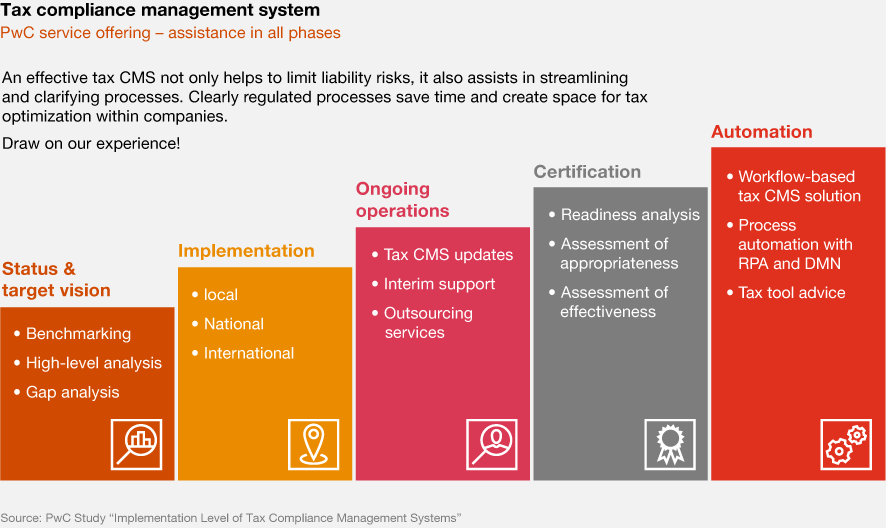

Are you uncertain whether your company needs to catch up in the area of tax CMS? Would you like to know where you stand in comparison to other companies with regard to your tax CMS? We will be pleased to provide you with individual tax CMS benchmarking – simply contact us.

Meet our team

- Your contact person for the region Central

- Your contact person for the region North and East

- Your contact person for the region West

- Your contact person for the region Southwest

Your contact person for the region Central

Christian Scheminski

+49 69 9585-6418

Email

Contact us

Contact us

Partner, Global Tax and Legal Managed Services / Alliances Leader, PwC Germany

Tel: +49 160 7032368