Your expert for questions

Marc Göbbels

Partner, Sustainability in Deals

Nachhaltigkeitsberatung bei PwC Deutschland

Email

“The heat is on”, warns the Chief Risk Officers Forum urgently in its position paper. The Forum estimates that the climate emergency could lead up to USD 550 trillion in losses around the globe. But rising global temperatures are not the only existential financial threat faced by companies. Other ecological and social risks can also jeopardise a company’s future. Because of this, when transactions take place the focus is increasingly falling on sustainability – for corporates as well as for private equity firms. ESG criteria – which examine environmental, social and governance risks – are thus crucial to an investment’s success.

When companies neglect to consider sustainability, they can run into serious difficulties: for instance, deficiencies in sustainability standards can lead to negotiations breaking down, falling transaction prices or depreciation in the value of an investment after negotiations because national or international standards were not complied with.

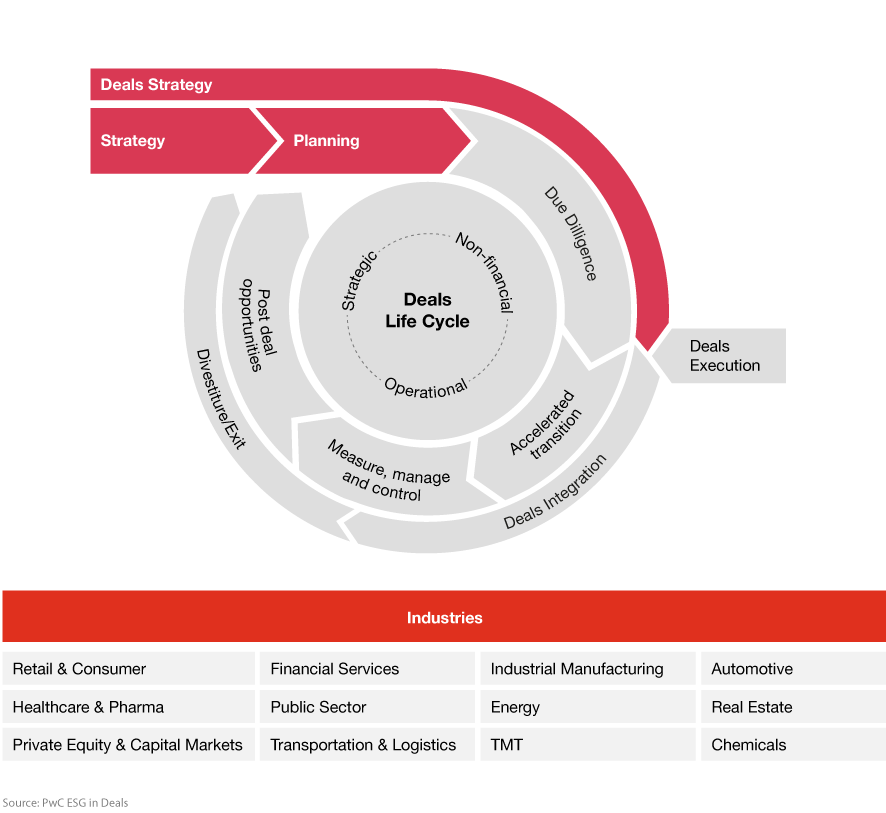

It is even more important to consider ESG criteria throughout the entire deal lifecycle when buying or selling a company. Sustainability can become a key value driver in a transaction. That’s because as a value proposition, ESG factors often justify a much higher purchase price, thereby increasing an investment’s resilience after acquisition – and thereby also its exit value. At the same time, national and international standards which compel all stakeholders in a deal to take action – such as the UN Principles for Responsible Investment (PRIs) – are growing in significance. Going forward, companies will have to engage with these regulations, as well as with new megatrends and a changing market situation. PwC helps corporates and private equity firms to reduce their ESG risks in transactions and turn them into opportunities.

At every step of the transaction process, every stakeholder faces a variety of questions and challenges:

PwC offers you an experienced team of ESG experts who will provide you with end-to-end assistance throughout the entire transaction lifecycle. Stay one step ahead of your competitors. Given the ever-rising expectations of the market and regulators with regard to sustainability, it is crucial to build trust, cut costs and realise value in transactions. PwC can assist corporates as well as private equity firms in this process.

Deals Service advice for Corporates (M&A): PwC assists on transactions on the buyer and the seller side, for instance with assessing a target based on ESG due diligence, with integrating the target into the buyer’s sustainability strategy and with defining, measuring and reporting KPIs. PwC’s advisory services also cover capital markets transactions relating to spin-offs and carve-outs.

Deals advice for Private equity firms: PwC offers advice at the level of General Partner (GP), Limited Partner (LP) and the portfolio – starting with positioning for a sustainable future and selecting targets, through to ESG due diligence for a final offer. PwC also assists private equity firms in setting sustainability goals, defining KPIs and measuring, steering and reporting them. PwC can also help them develop an ESG profile for the portfolio companies with a view to value-enhancing exit readiness.

ESG positioning: Review client’s ESG strategy/policy, determine ESG materiality and identify target companies accordingly.

Business profiling: Perform background research on select business partners and key individuals as well as high level country risk assessments e.g. focusing on the impact of political risks on target’s business operations and human rights.

We are on your side when it comes to identifying the main ESG risks and transforming them into opportunities. In an environment of rising expectations on the part of the public and strict requirements, we place great store in building trust, and bolstering your reputation in matters of sustainability. By taking into account ESG standards, we can work together with you to cut costs and realise value – at every step of the transaction process. We offer bespoke services and apply best practices and intelligent technology in our solutions.

“Social transformation, the climate emergency, the loss of biodiversity and shortages of resources are megatrends which can develop into existential threats for companies that fail to ready themselves to tackle them. The right ESG strategy enables firms to increase their value and build trust.”