Investors: High demand in esports attracts big brands from various industries

By Disht Advani, Koray Anil Akman. Esports has become an attractive market for strategic and financial investors. The increasing amount of consumers in esports enables profitable returns through a wide range of business development opportunities. Professional players and teams, whom millions of enthusiastic gamers cheer on, present a huge opportunity for strategic investors to commercialize brands and positively affect their bottom line. The increasing returns are enticing for financial investors too. Esports has become a rapidly growing global industry, with a fan base of about half a billion people and with revenue expected to reach €1.2 billion this year for the first time. The business has seen growth of 15.6% since last year. Furthermore, many reports have forecasted that esports will generate revenue of €1.9 billion in 2024. Nevertheless, despite the growing demand from consumers, investors are still concerned

about further investments due to lack of knowledge about the ecosystem of esports. Financial investors tend to focus too much on P&L statements rather than on the strategic aspects of esports. It is crucial to understand that investors should act now if they want to invest in the esports market. Though the esports industry is still recovering from the impact of the COVID-19 pandemic, investments started to increase in the month of June. Well-known celebrities such as David Beckham ventured into esports, Fortnite developer Epic Games sought to raise three-quarters of a billion dollars, and the South Korean company BRION E-Sports partnered with several celebrity investors to apply for the upcoming League of Legends Champions Korea franchising. In June, esports-relevant companies reported $196.8 million in investments, bringing the total sum of disclosed investments in 2020 to $1.1 billion.

Why investors underestimate esports

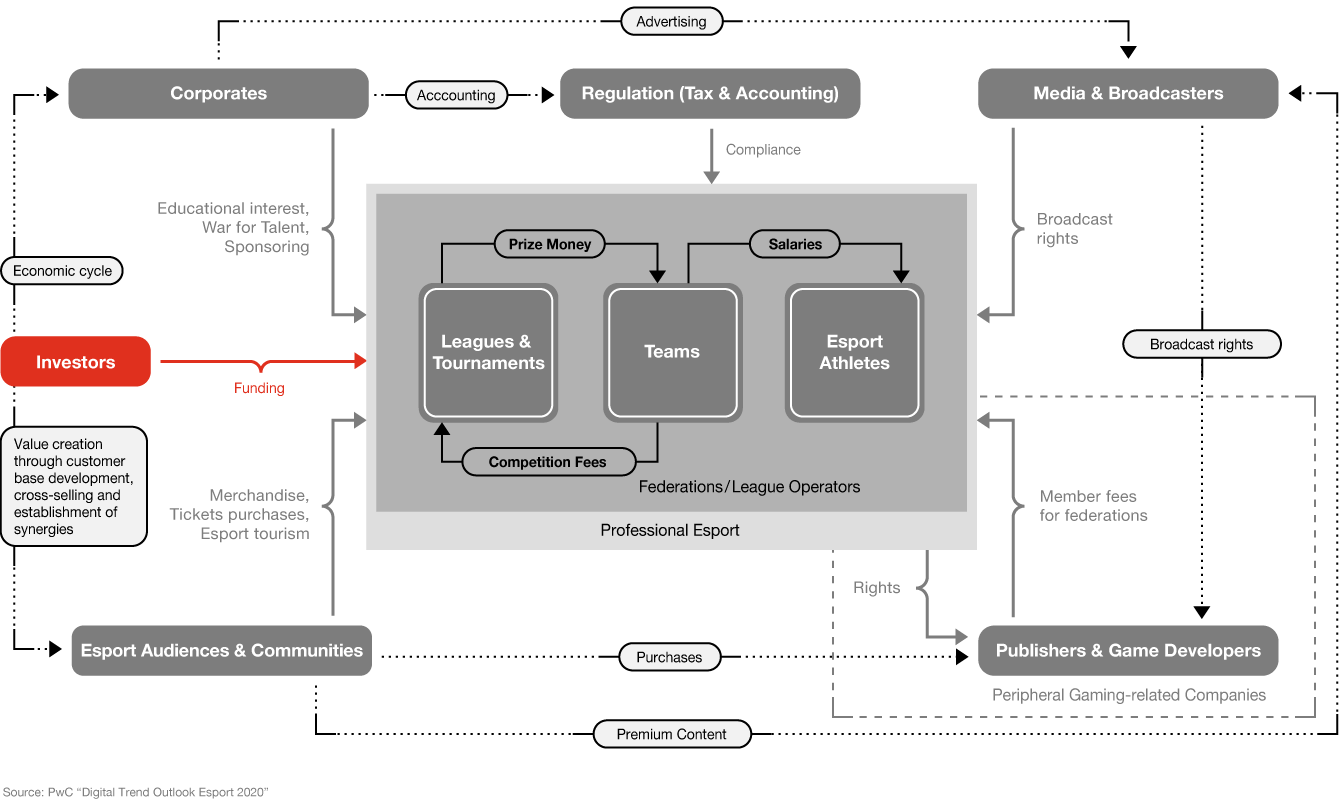

Many investors used to believe that esports was not a long-term trend. In fact, it is even more than a long-term trend, evolving from a growing live sport with high entertainment characteristics into a leading factor in pop culture that has a significant impact on all games. As soon as they hear this term, they categorize it as a tiny subsector. Another reason for the confusion of potential investors is the way of investing in this growing industry. It is possible to invest in esports in the same way as traditional sports such as soccer. It is crucial to illuminate the ecosystem of esports to understand which stakeholders are involved and where the profits are coming from.

In summary, investors do not see the value proposition despite the tremendous amount of viewership. It is important to understand that esports is fundamentally intertwined with games. While nobody owns football or basketball, the games on which esports depends are owned by their publishers. Investors must understand that esports should be viewed in the wider context of the ecosystem and that strength lies particularly in its convergence with adjacent industries. It is part of a larger culture—the different areas of life of the players and fans.

How to invest in esports

Investors have many options for participating in the growing esports industry. The easiest way to invest is to buy stocks in major publishers. They can also invest in esports organizations or tournaments, which are visited by thousands of enthusiastic gamers. Another option is for them to establish a partnership with esports organizations, publishers or players to raise awareness of their brand or ensure profitable returns in the long term.

News of the awareness and great potential of esports have reached financial and strategic investors alike. Despite that, investors still lack knowledge about the ecosystem of esports and how the top-tier esports organizations operate. However, the interest is definitely there. Leading investors have started working with top consulting firms and get engaged by leading investment companies to understand the esports market and to benefit from it effectively.

Investments in traditional sports like basketball, baseball or football are common, but people wonder why investors have started to invest in esports. The reason for watching basketball matches is to watch outstanding athletes play, as everyone understands how difficult it is to play at such a high level. The same applies for esports.

Smart money betting on esports

While esports is catching up, it is also important to remember that the frequency of ticket sales or viewership does not necessarily equate to high revenue. For instance, as per the view in Venture Beat an article on Germany predicted the Bundesliga earns a revenue of around €50 per fan, while that number is only €2.72 for esports fans. Esports is still in its infancy, and there is clear interest and strong potential to monetize the growing fan base. To achieve this, the industry needs to focus on targeting the right audience in the right way, incentivize Esports involvement and expand interaction with stakeholders other than players.

Smart investors like to spend capital where consumer behavior and technology collide to create the biggest investment opportunities. According to industry experts and specialists, the three winning sports of the future will be football, basketball and esports.

An increase in prize money has helped accelerate the professionalization of the industry and main events. The professionalization of the sport has drawn in major players with big prize winnings and large fan followings. The top ten esports players have accumulated more than $35 million in prize winnings. Top players draw in large, loyal fan bases that watch hours of their streams from league play and practice.

Esports attracts the brightest young minds for a start-up community of many different businesses. Some are looking to diversify their current portfolios, whereas others are looking to expand their holdings. Fans have watched the Houston Outlaws play in the league for Overwatch, a game owned by Activision Blizzard. Overwatch team owners offer a clue to esports’ crossover appeal, according to some smart money. Robert Kraft from the Patriots, Jeff Wilpon from the Mets, Stan Kroenke from the Rams and Nuggets, and Dave Scott from the Flyers were among the original team owners who had to pay Activision $20 million each for a team. The speculation is that the teams added next year could cost $60 million (€50 million). With all these investments pouring in Activision needs to improve its infrastructure otherwise it would have massive problems from its rising competition like Valorant. Activation had a huge issue recently with Modern Warfare wherein the download was at an incredible delay as well as there were severe problems with users data caps.

A few years ago, Michael Lewis, the author of Moneyball, provided a good look at monetization in sports. Lewis believed that the next big short after the NFL, for instance, is the 1.2 billion hours of viewership of League of Legends Championships. More than 80 million unique viewers watched one match alone. By comparison, 76 million watched the final episode of Seinfeld, the Super Bowl of traditional television. As astonishing as this may sound, imagine how advertisers are trying to chew on this exponential opportunity while some of their traditional platforms are being spit out with declining viewership.

Justin Kan has described the Twitch streaming idea as “lifecasting.” In 2014, Amazon bought the streaming service for $970 million, which has proven to be an absolute steal. Twitch already has more viewers than CNN and MSNBC. The video game online streaming audience is more than five times greater than Netflix subscribers, and Twitch dominates this market. The total number of creators earning money has more than tripled year over year—all with enough left over for Twitch to raise more than $30 million for charities in the past year.

The revenue side has explosive scale while the cost per broadcast has to be even more enticing to future creators. A broadcaster on Twitch needed a cheap webcam and comfortable chair. Compare that to an itemized cost to produce an average football game on television there are two dozen broad categories long on Twitch (for a declining audience).

Multiplying fast consumption by more games on more days than any other sport results in an incomparable scale over any other sport for sponsors and streaming. And the virtual playing field is getting faster. According to Recode Media, global internet speed overall increased by 30% in 2017. Technology will also be key in growing fan engagement with tournaments and content. Additionally, VR/AR headsets will allow fans to engage immersively with competitions from their homes. Stepping into the virtual world will help draw esports closer to the world of traditional sports, improving how fans interact with the content and engaging them for longer. Lastly, 5G will also allow publishers to create more sophisticated and realistic gaming without the risk of increased latency and disruption online, helping further grow the audience.

New wave of investment and M&A in the esports industry

The key industry trends predict that the industry will pass $1 billion of investment this year due to the industry’s strong expected growth, potential for diversification and hedging, and unique customer base, which are intriguing propositions within the industry’s ecosystem. Additionally, esports and gaming dominate pop culture and represent the immersive entertainment the current generations crave. Esports and gaming platforms have become a place to socialize, meet friends and exchange experiences culturally beyond gaming.

The growth has attracted both financial and strategic investors. Nevertheless, venture capital firms are still the most significant group of investors in the esports industry. This phenomenon indicates that the majority of esports organizations are still developing and require a clear strategy to focus on business profitability. Similar to the global industry, the esports market within the ecosystem in Europe provides multiple stakeholders with different investment opportunities.

Furthermore, esports also provides access to global markets and customers. For instance, Riot Games LEC and Blast partnered with NEOM, the $500 billion future city being built by Saudi Arabia. However, due to the country’s stance on ‘equal rights for all’, there was significant backlash from Riot employees and fans, causing Riot to cancel the deal shortly after the announcement. This is a clear example of how the company tried to expand its esports ecosystem and partnership but caused rifts in the very community they tried to grow.

The lack of engagement in traditional sports has led to a significant drop in advertising as highlighted on WeForm. This has led to further interest in esports. The key insight from M&A activity is that it has consistently tracked with overall financing, including its upward growth in deal count annually over the past five years. As overall financing flows into the esports and gaming industry in the next five years, expect to see a continued shift from early-stage to late-stage investment and greater M&A activity.

Potential attractive segments for external investors

Publishers and developers’ businesses are tied to the quality of the games produced, and the revenue flow can be extremely variable. On the other hand, league organizers have a wide range of potential revenue sources, including media rights and sponsorship. Furthermore, distributors have an attractive business model with multiple sources of monetization providing a smooth revenue flow. The success of the overall esports market should also ideally help boost the type and size of business. However, it can be argued that there are currently a limited number of investment opportunities available.

Teams are relatively small in terms of revenue generation, but are growing rapidly. The success of the business largely depends on the quality of players rather than the strength of business operations. Compared to other traditional sports, the investment costs are low, and now might be the right time to invest. Nevertheless, a strategic decision must be made based on how the investment fits into the current investment portfolio and how synergies can be created. With the right strategy, it is possible to ensure a sustainable investment that fits the current portfolio in the long term.

The table below provides a list of transactions and partnerships that have occurred across the globe. The number of transactions and partnerships is significantly higher than 2019. China and the US lead the global transactions and partnerships. However, Germany is the leader in esports transactions and partnerships in Europe.

Selected deals and partnerships over the past few months

- Europe

- Americas

- Asia, Australia and the Middle East

Europe

Country code: DE

Company: Erste Group

Esports organization: LEC

Description: Erste Group establishes a partnership with the League of Legends European Championship League (LEC).

Read more

Country code: DE

Company: T-Mobile and Metro

Esports organization: Andbox

Description: T-Mobile and Metro extend their partnership with Andbox.

Read more

Country code: GB

Company: Kappa

Esports organization: Demise

Description: Demise agrees to a three-year deal with the sportswear brand Kappa.

Read more

Country code: GB

Company: Kappa

Esports organization: Demise

Description: Demise agrees to a three-year deal with the sportswear brand Kappa.

Read more

Country code: GB

Company: Euronics

Esports organization: ESL Pro League

Description: The electrical goods retailer becomes the official partner of the digital ESL Pro League.

Read more

Country code: GB

Company: Rogue and London Royal Ravens

Esports organization: Find Your Grind

Description: Rogue and London Royal Ravens are the new sponsors of the educational foundation Find Your Grind.

Read more

Country code: CH

Company: Nescafé

Esports organization: Team SMG

Description: Team SMG establishes a partnership with Nescafé.

Read more

Country code: CH

Company: Hublot

Esports organization: Ferrari Driver Academy

Description: Watch manufacturer Hublot secures the naming rights for the championship of the Ferrari Driver Academy.

Read more

Q1 and Q2 saw M&A activity slow down substantially. However, the M&A and partnerships action is sure to heat up in the next few months. Content, analytics, chat and voice communication technology, talent management and esports-oriented social networks, among other services, will come out of the woodwork over the next few years as the market becomes more sophisticated. Esports are set to be included in the 2022 Asian Olympics, with serious discussion surrounding bringing competitive video gaming to the 2024 Olympics in Paris.

Strategic and financial investors alike have the opportunity to get sustainable returns. For strategic investors, esports provides limitless business development opportunities. The unique opportunity to reach millions of people with particular channels will accelerate business and ensure market position, even allowing companies to gain an edge on their competitors. It is crucial to act on time, before it is too late or the costs are too high.

The amount of investments have already started to increase particularly among the strategic investors. With the right knowledge of the Esports ecosystem, accurate investment strategy along with a rigorous view through due diligence significantly demonstrates faith to the investor community. The volume of investments has already started to increase, particularly among strategic investors. With the right knowledge of the esports ecosystem backed by a community and the right investment strategy, the value proposition will be guaranteed.

Contact us

Werner Ballhaus

Global Leader Entertainment & Media, Partner, PwC Germany

Tel: +49 211 981-5848

Gian Luca Vitale

Gaming & Esports Business Advisory, Senior Associate, PwC Germany

Tel: +49 175 8534-794

Contact us

Werner Ballhaus

Global Leader Entertainment & Media, Partner, PwC Germany

Tel: +49 211 981-5848