Media & Broadcasters: The golden link in esports in the digital era

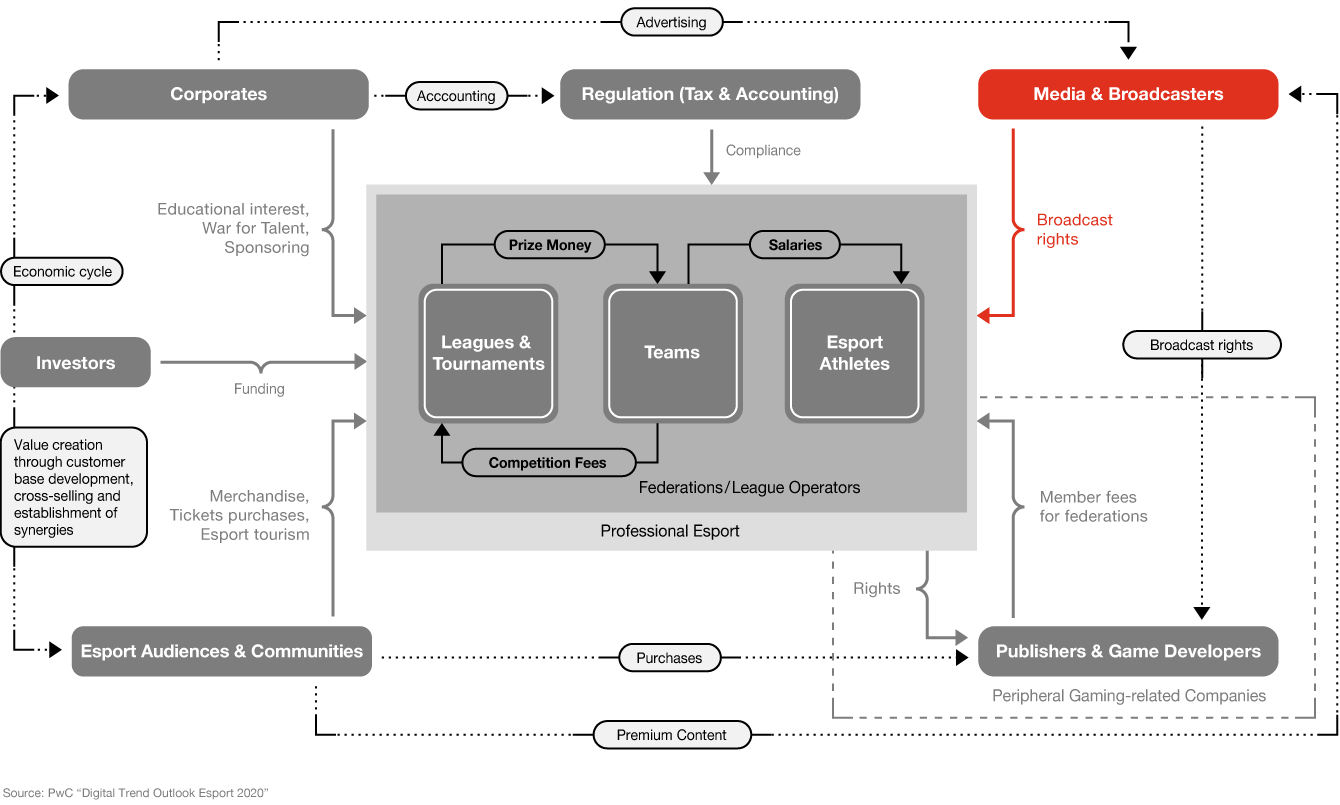

By Disht Advani. Esports is entertainment. But at its core, it is even more - it is a culture. There is no monetization without the fans having the appropriate channels to follow their teams and heroes, socialize with the community and share their special moments. Revenue in the German esports market is set to grow to over €200 million in the years ahead. Sponsorships and advertising income are essential for the whole ecosystem

and depend heavily on the viewership of leagues, tournaments and festivals. The popularity of esports, and its growth during the crisis, has led to an estimated increase in engagement of close to 25% in Germany. In this rapidly changing environment, streaming platforms have established themselves as the number one platform, and they are on their way to expand to other life areas beyond gaming and esports.

The importance of streaming platforms for the esports industry

Game-specific streaming platforms such as Twitch, Huya Live, and YouTube enable fans to have a direct connection to teams, players and influencers, thus creating and maintaining a sense of ownership and closeness that stands out more than in every other entertainment and sports sector. Traditional broadcasting and media companies such as ESPN are also trying to get a foot in the door. However, traditional media companies have so far stood little chance against the big streaming platforms—a situation that appears likely to continue in the future. Twitch and YouTube have capitalized on network effects, built and optimized their infrastructure and ecosystem, and elbowed out most of the competition. They will now decide the race with relevant and engaging content from which partners and players of those ecosystems can benefit.

It is no secret that traditional TV viewership is declining among young people, the most important target group for esports and gaming. Instead, on-demand platforms, where consumers can decide for themselves what they want to watch and when, are gaining popularity. Another key advantage of streaming platforms is their flexibility. Twitch, YouTube and Facebook, to name a few, can be watched on almost any device at home, on the road or in another country. Probably the most important factor for streaming platforms, however, is the social aspect. Fans can engage with each other in chat rooms and exchange their thoughts about what is happening in the game at this very moment. The next generation of development will focus more on individualization, greater possibilities for immersive participation and engagement, and a next level of quality in production without losing the traditional appealing charm of an organically grown community that is reflected in its language, forms of interaction and lighthearted humor.

Twitch continues to boost esports and act as a real catalyst

The most important streaming platforms in the western world include Twitch and YouTube. Facebook has also risen to prominence following the closure of Mixer. According to TechCrunch, Twitch dominates the live streaming market, with more than 2.7 billion hours watched and a 72% share of total live hours in 2019. Twitch is followed by YouTube (19.2%), Facebook Gaming (5.3%) and Mixer (3% prior to its demise). It is important to mention that this statistic captures gaming and esports. Furthermore, esports and its associated brands account for 24.2% of the hours watched in the top 200 channels.

One advantage of Twitch is the possibility of diversification. When creating an account, users can specify which games they are interested in. Systematically allowing viewers to indicate that they want to follow players from a specific team or with a specific rank—something currently only possible through the deft promotion of streamers—could be a future option.

Alternatively, it is vital for brands to realize the value of the audience through their willingness to spend on esports in addition to the mass audience target. However, with catching-up costs set to rise drastically, any brands and corporates that have yet to realize that social media channels are the place to be, and have yet to grasp the importance of streamers as influencers or the relevance of esports and gaming for reaching the younger generation, may face obstacles going forward. Although there is still enough space, several brands are way ahead in creating stable and relevant relationships with the audience, leaving less space for other brands to find their place in the minds of this generation and join the relevant set of brands.

In the US, UK, Germany and France, the esports audience is more likely than the general gamer population to subscribe to Spotify, Netflix and HBO. For instance, 22% of the population surveyed subscribe to Spotify (11% of the gamer population), 46% to Netflix (34%) 35% to HBO (21%). This group is willing to pay for its increased digital media consumption as long as it provides value added in terms of entertainment, quality of life improvements and sociability and sharing improvements.

Exclusive deals are becoming more relevant for attracting users, but carry a risk

In recent years, many of the big streaming platforms have made exclusive deals with publishers of popular esports titles. According to Sports Business Daily, Twitch paid at least $90 million for the streaming rights to the first two seasons of Activision Blizzard’s Overwatch League. At the beginning of this year, news came out that YouTube had struck a deal with Activision Blizzard for the exclusive right to show the Overwatch League, the Call of Duty League and Hearthstone events. According to Esports.com, Google is paying the incredible amount of $160 million for this strategic partnership. Another example is Fox Sports, which announced a broadcast and streaming deal with FIFA for several years in 2019.

What is interesting here is also a change in the ways esports can be consumed. Although the live streaming audience numbers seem to be low on YouTube, the restreaming numbers have grown substantially. This opens two aspects: On the one hand, the number of streamed esports competitions on offer has grown, and the audience is more and more forced to decide where to spend their limited time resources. On the other hand, the audience uses the possibility of restreaming in order to not miss a shot. This shows that YouTube is gaining more relevance and is slightly building on its strength when it comes to this phenomenon. In fact, Twitch needs to catch up with this consumption behavior. In the long run, this will help the ecosystem to grow overall. It will also be interesting to see how these two platforms will catch on in the future and adapt to the specifics of esports competition consumption. Brands need to be aware of such details and facilitate those movements more in their ways when it comes to media exposure.

Esports is lucrative for advertising

Advertising and sponsoring, both endemic and non-endemic, are increasing rapidly in the esports industry. A decisive advantage of esports advertising is that it reaches Millennials and Generation Z in particular—a target group that is difficult to reach using conventional methods.

One of the reasons for this is the huge amount of different possibilities for advertising, as well as the many ways in which brands are expected to position themselves. For example, commercials and campaigns on the streaming platform, Twitch, work much differently than on television. Streamers decide for themselves whether they want to play commercials and when to play them. Commercials can therefore be more authentic, and the audience is more invested in the ads, knowing that they are necessary for the careers of their idols. In-game advertising is another way to seamlessly integrate commercials into esports and to further monetize the increasingly large audience. Still, this method is used only sparingly, the reason being that brand advertisement without any authenticity or value added for the audience feels more annoying than anything else. The closer to the game (which is the real entertainment and source of interest), the more dangerous the potential backlash, and the more sensitive the community is in either appreciating or dismissing the activity. This will also stay true for the future, although the possibilities appear impressive. Brands and companies need to get familiar with the concept of branded entertainment, which can transform esports into a fantastic world of creativity beyond the limits of classic sports.

Seeing Coca-Cola cans with pictures of soccer players on them during the World Cup is nothing new. The marketing strategy is to leverage fans’ engagement for soccer and transfer this enthusiasm to the product. This strategy, however, is no longer unique to traditional sports. Red Bull, a major sponsor in esports, offers cans with pictures of the most famous Fortnite streamer, Ninja, on them. The esports audience is very passionate about the game and has a deep connection to its favorite teams or players. Sponsors can take advantage of that by utilizing this passion for their products as well.

It is essential for sponsors to know the demographics and attitudes of the audience in order to ascertain whether sponsorship and/or advertising makes sense. The various esports titles could not be more different: one game involves playing soccer with cars, while another sees players competing as terrorists and counter terrorists. Accordingly, both the demographics and attitudes of the respective audiences are different, resulting in specific commercials being more or less effective. It is therefore important for sponsors to take a closer look at the respective game as well as the respective broadcasting channel.

Despite all these advantages and the enormous growth potential, advertising and sponsorship in esports is still relatively cheap compared to traditional sport. This could mean enhancement of the viewer experience through multiple applications and also additional help to connect with the brand. The benefit is that the average age is young, engaged and loyal to brands that are truly in the ecosystem. Therefore it is important for brands to quickly develop an esports advertising strategy and enter the market before the esports industry grows even bigger.

COVID-19 shows that esports is a must for media companies

Many media companies did not take esports seriously in its early days, and only a few were covering it the same way as traditional sports events. This has changed rapidly in recent years and has been further enhanced by COVID-19.

Just like any other industry, esports definitely was affected at the beginning of the outbreak. Large tournaments that would have filled entire halls and soccer stadiums had to be cancelled or postponed. The huge audience at events is definitely an important factor for the esports industry, similar to traditional sports such as soccer, basketball or football. For esports however, the physical attendance of fans is not as crucial as for some of those sports. While an impressive 40,000 spectators attended the League of Legends World Championship Finals in China, approximately 100 million watched the game from home (Ipso.com).

Esports is therefore not as dependent on spectator income on site. While most sports have been cancelled for some time, esports has been able to adapt quickly to the changed conditions, and many tournaments are being held either without spectators or directly online. Experts even believe that the coronavirus crisis is an advantage for the esports industry. Media companies that had previously relied on esports are benefiting from higher audience figures, and many media companies new to the industry are now also trying to acquire rights to fill the gap in sports broadcasting.

Newzoo forecasts that the total esports audience in Germany will grow to over 10 million in 2020. Of that total, 53% will be occasional viewers, and the rest will be esports enthusiasts. The number of viewers has doubled over the past year. It is estimated that this number is only set to increase from this point. As esports is growing and moving away from its traditional stereotype, some of the world’s top brands are getting involved with the sport. This in turn further increases the excitement and further engages people with the sport.

To conclude, media value is only one element of the overall measurement of sponsorship success. Brands are ultimately turning to partnerships as a way to build deeper relationships with fans, and in turn to improve affinity toward—and, ultimately, likelihood to purchase—their products. Lastly, video streaming services like Netflix are more worried about esports streaming than direct competitors due to the disruptive nature of this sector.

Contact us

Werner Ballhaus

Global Leader Entertainment & Media, Partner, PwC Germany

Tel: +49 211 981-5848

Gian Luca Vitale

Gaming & Esports Business Advisory, Senior Associate, PwC Germany

Tel: +49 175 8534-794

Contact us

Werner Ballhaus

Global Leader Entertainment & Media, Partner, PwC Germany

Tel: +49 211 981-5848