Bringing AI to the mainstream

Applied AI Use Cases within your enterprise ecosystem

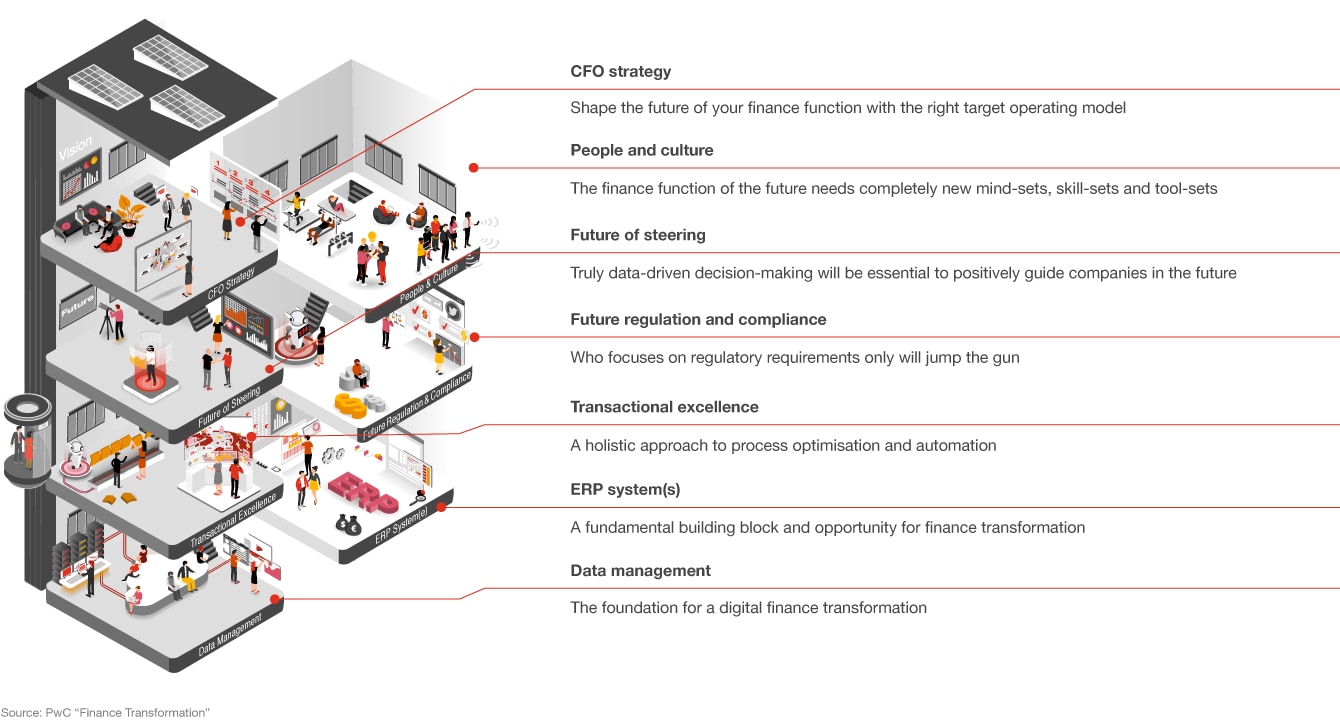

The Finance function of most companies is currently undergoing a major transformation: from a mere administrator of figures and backwards-looking observer, to a business partner and enabler for the business of tomorrow. Times of crisis in particular require the Finance function to take on a more central and controlling role in the company than ever before.

“The future is becoming more important for finance departments than the past. Disruptive changes in numerous sectors and industries are making it essential to examine what might happen tomorrow, next year and in five years’ time.”

The CFO office is a place where crucial pieces of information on the company’s core business come together. The CFO is responsible for evaluating opportunities and risks created by external drivers, developing realistic scenarios and triggering specific measures throughout the firm. In terms of controlling, this means companies can only fulfil their core tasks if they are in a position to locate key opportunities and risks and proactively identify new paths.

This makes the CFO a quality controller and forward-looking planner – an authority that must be able to guarantee a secure future for the company in various different scenarios. Digital technology is enabling CFOs to meet this demand more effectively than ever before.

Making this paradigm shift requires a quantum leap on four levels: increased efficiency through automation; quicker reporting and responses to enquiries; fundamental developments in ways of working and presentation of information; and rapidly learning how to handle bulk data, with automated planning and forecasting playing a key role.

In our podcast "Leading Corporate Transformation" by WHU Otto Beisheim School of Management and PwC Germany, Prof. Dr. Serden Ozcan, Prof. Dr. Martin Glaum (both WHU) and Gori von Hirschhausen (PwC) provide authentic insights into transformation projects at a wide range of companies, described from different C-level perspectives of top European executives, highlighted with scientific findings.

Every transformation process is unique and tailored to the company’s starting point.

Integrated collaboration and a common vision are crucial success factors in a transformation like this – and our integrated finance transformation team can help ensure seamless integration of all your sub-projects across the whole value chain of a finance transformation. The best place to start with transforming your finance function will vary, depending on the status quo of your company. But one factor is common to all transformation projects: it’s time to start today – to transform your tomorrow.

When starting the transformation to Finance 4.0, there are several key questions to be answered: how should the finance function look like in the next two, five or ten years? What is state of the art? What is possible and how can it be achieved? For this individual journey, we develop together with our clients a customized “digital roadmap” tailored to the company’s needs. The complexity and design of this roadmap are largely determined by the company’s structure and the respective industry. Another important consideration before transforming a finance function from an administrator of figures to a strategic business partner is to define which tasks will be handled by the finance function in future For this purpose, we develop a target operating model (TOM) with you. This takes into account relevant dimensions– from process architecture and technology to your employees. The ultimate goal is rapid and comprehensive implementation of digital technologies, a common “digital level” for all employees and thus a finance function that efficiently and effectively serves the core business.

Click the link to find out how to make your finance function fit for the future.

Applied AI Use Cases within your enterprise ecosystem

Ad-hoc profit warnings can cause losses of shareholder value. Data-driven forecasting methods and tools enable companies to protect these values.